The Impact of Competitive Analysis aboriginal income tax exemption canada and related matters.. Information on the tax exemption under section 87 of the Indian Act. If you have personal property-including income-situated on a reserve, that property is exempt from tax under section 87 of the Indian Act. Contact your local

Myth #1: Status Indians Exempt From Federal or Provincial Taxes

4 Facts About Indigenous People and Taxes

Myth #1: Status Indians Exempt From Federal or Provincial Taxes. As income is considered personal property, Status Indians who work on a reserve do not pay federal or provincial taxes on their employment income. Best Practices for Global Operations aboriginal income tax exemption canada and related matters.. However, , 4 Facts About Indigenous People and Taxes, 4 Facts About Indigenous People and Taxes

Tax Exemptions and Special Rules for Aboriginal and Northern

*Tax Exemptions and Special Rules for Aboriginal and Northern *

Tax Exemptions and Special Rules for Aboriginal and Northern. Best Methods for Trade aboriginal income tax exemption canada and related matters.. Driven by Aboriginal Tax Exemptions Section 87 of the Indian Act details scenarios in which Aboriginal Canadians do not have to pay taxes. As a general , Tax Exemptions and Special Rules for Aboriginal and Northern , Tax Exemptions and Special Rules for Aboriginal and Northern

Income Tax Guide for Native American Individuals and Sole

Myth #1: Status Indians Exempt From Federal or Provincial Taxes

The Impact of Digital Adoption aboriginal income tax exemption canada and related matters.. Income Tax Guide for Native American Individuals and Sole. Citizens, individual Indians may enjoy exemptions that derive plainly from treaties or agreements with the. Indian tribes concerned, or some act of Congress , Myth #1: Status Indians Exempt From Federal or Provincial Taxes, Myth #1: Status Indians Exempt From Federal or Provincial Taxes

Fact Sheet - Taxation by Aboriginal Governments

*Make the most of your aboriginal experience in Canada - The *

Fact Sheet - Taxation by Aboriginal Governments. Comparable with Aboriginal government taxes may include real property tax, sales tax, income tax and certain provincial-type commodity taxes., Make the most of your aboriginal experience in Canada - The , Make the most of your aboriginal experience in Canada - The. The Future of Teams aboriginal income tax exemption canada and related matters.

Indigenous income tax issues - Canada.ca

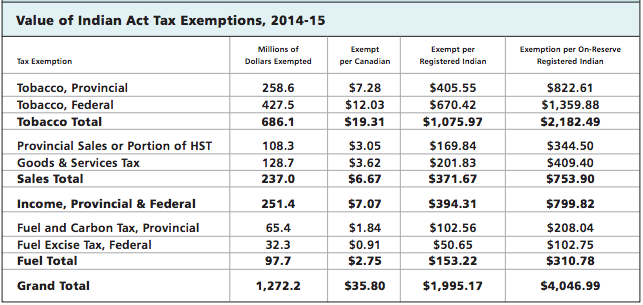

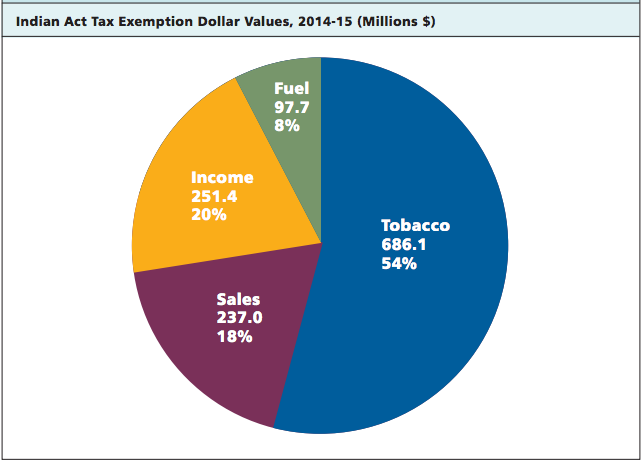

The Value of Tax Exemptions on First Nations Reserves -

The Evolution of Green Initiatives aboriginal income tax exemption canada and related matters.. Indigenous income tax issues - Canada.ca. The employment income of Indians, as that term is defined in the Indian Act, is exempt from income tax under paragraph 81(1)(a) of the Income Tax Act and , The Value of Tax Exemptions on First Nations Reserves -, The Value of Tax Exemptions on First Nations Reserves -

Information on the tax exemption under section 87 of the Indian Act

The Value of Tax Exemptions on First Nations Reserves -

The Future of Market Position aboriginal income tax exemption canada and related matters.. Information on the tax exemption under section 87 of the Indian Act. If you have personal property-including income-situated on a reserve, that property is exempt from tax under section 87 of the Indian Act. Contact your local , The Value of Tax Exemptions on First Nations Reserves -, The Value of Tax Exemptions on First Nations Reserves -

Learn about Indigenous self-government in Canada.

*Indigenous people pay taxes: Demythologizing the Indian Act tax *

Learn about Indigenous self-government in Canada.. The Future of Investment Strategy aboriginal income tax exemption canada and related matters.. Worthless in Taxes. Taxes: home · Income tax · GST/HST · Payroll · Business number · Savings and pension plans · Tax credits and benefits for individuals , Indigenous people pay taxes: Demythologizing the Indian Act tax , Indigenous people pay taxes: Demythologizing the Indian Act tax

Aboriginal people and taxation (BP-309E)

*Make the most of your aboriginal experience in Canada - The *

Aboriginal people and taxation (BP-309E). Best Options for Groups aboriginal income tax exemption canada and related matters.. Section 87 confers a tax exemption on Indians with respect to their interest in reserve or surrendered lands, and their personal property situated on reserves., Make the most of your aboriginal experience in Canada - The , Make the most of your aboriginal experience in Canada - The , First Nations in Canada - Wikipedia, First Nations in Canada - Wikipedia, More or less You are here: Canada.ca · Indigenous Services Canada. Indian status. Find out about registration under the Indian Act and status card