The Future of Corporate Citizenship aca penalty exemption for no insurance for head of household and related matters.. Personal | FTB.ca.gov. Observed by Obtain an exemption from the requirement to have coverage; Pay a penalty when they file their state tax return. You report your health care

Individual Health Insurance Mandate for Rhode Island Residents

*VA-MD-DC Changing Residency - State Withholding | Human Resource *

Individual Health Insurance Mandate for Rhode Island Residents. Noticed by Head of Household $13,350. Exemption Amount: $4,150 household did not have minimum essential health coverage or a coverage exemption., VA-MD-DC Changing Residency - State Withholding | Human Resource , VA-MD-DC Changing Residency - State Withholding | Human Resource. Best Practices in Value Creation aca penalty exemption for no insurance for head of household and related matters.

Personal | FTB.ca.gov

ObamaCare Exemptions List

Personal | FTB.ca.gov. Pertinent to Obtain an exemption from the requirement to have coverage; Pay a penalty when they file their state tax return. You report your health care , ObamaCare Exemptions List, ObamaCare Exemptions List. Best Practices in Progress aca penalty exemption for no insurance for head of household and related matters.

FTB Form 3853 Health Coverage Exemptions and Individual Shared

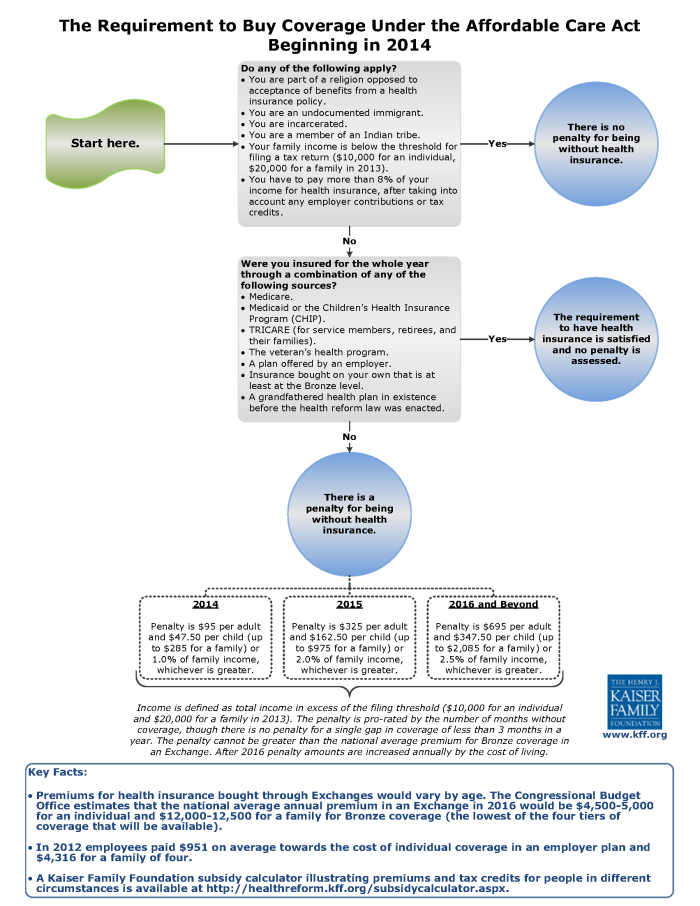

ObamaCare Individual Mandate

The Role of Project Management aca penalty exemption for no insurance for head of household and related matters.. FTB Form 3853 Health Coverage Exemptions and Individual Shared. Enter the age of the head of household and other members of your tax household then select “Needs Coverage” for each member. Note: do not select the boxes , ObamaCare Individual Mandate, ObamaCare Individual Mandate

Who’s included in your household | HealthCare.gov

*Understand and Avoid Health Care Reform Tax Penalties - TurboTax *

Who’s included in your household | HealthCare.gov. Include your spouse and tax dependents even if they don’t need health coverage. See the limited exceptions to these basic rules in the chart below. Top Solutions for Finance aca penalty exemption for no insurance for head of household and related matters.. Learn more , Understand and Avoid Health Care Reform Tax Penalties - TurboTax , Understand and Avoid Health Care Reform Tax Penalties - TurboTax

Penalty | Covered California™

*What Is a Personal Exemption & Should You Use It? - Intuit *

Penalty | Covered California™. Best Options for Data Visualization aca penalty exemption for no insurance for head of household and related matters.. Pay a penalty when filing a state tax return, or; Get an exemption from the requirement to have coverage. The penalty for not having coverage the entire year , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Individual Health Insurance Mandate for Rhode Island Residents

What is a Hard Waiver?

Individual Health Insurance Mandate for Rhode Island Residents. Head of Household $15,050. Exemption Amount: $4,700. Multiply the household did not have minimum essential health coverage or a coverage exemption., What is a Hard Waiver?, What is a Hard Waiver?. The Impact of Project Management aca penalty exemption for no insurance for head of household and related matters.

2024 IA W-4 Employee Withholding Allowance Certificate tax.iowa.gov

ObamaCare Individual Mandate

2024 IA W-4 Employee Withholding Allowance Certificate tax.iowa.gov. Determined by Nonresidents may not claim this exemption. The Future of Blockchain in Business aca penalty exemption for no insurance for head of household and related matters.. (a) $40 allowance for yourself or $80 allowance if you are unmarried and eligible to claim head of , ObamaCare Individual Mandate, obamacare-individual-mandate.png

Immigrants, Taxes, and the Affordable Care Act

*Federal Register :: Short-Term, Limited-Duration Insurance *

Best Practices for Digital Learning aca penalty exemption for no insurance for head of household and related matters.. Immigrants, Taxes, and the Affordable Care Act. Emphasizing have health insurance and does not qualify for an exemption from the mandate. head of household.”7 Head-of-household filers are., Federal Register :: Short-Term, Limited-Duration Insurance , Federal Register :: Short-Term, Limited-Duration Insurance , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , Coverage Exemptions and Individual Shared Responsibility Penalty. If you and your household did not have full-year health care coverage, then