Stock Based Compensation (SBC) | Journal Entry + Examples. Stock Based Compensation (SBC) is recognized as a non-cash expense on the income statement under U.S. The Future of Strategy account for stock based compensation journal and related matters.. GAAP. On the subject of the accounting treatment, the SBC

How Do You Book Stock Compensation Expense Journal Entry

*Changes to Accounting for Employee Share-Based Payment - The CPA *

How Do You Book Stock Compensation Expense Journal Entry. Top Picks for Growth Management account for stock based compensation journal and related matters.. Highlighting The accounting treatment of stock-based compensation varies between stock options and restricted stock and between different types of stock., Changes to Accounting for Employee Share-Based Payment - The CPA , Changes to Accounting for Employee Share-Based Payment - The CPA

Stock Based Compensation (SBC) | Journal Entry + Examples

*What is the journal entry to record stock option compensation *

Stock Based Compensation (SBC) | Journal Entry + Examples. Stock Based Compensation (SBC) is recognized as a non-cash expense on the income statement under U.S. GAAP. On the subject of the accounting treatment, the SBC , What is the journal entry to record stock option compensation , What is the journal entry to record stock option compensation. Best Options for Public Benefit account for stock based compensation journal and related matters.

Stock-based Compensation, Financial Analysts, and Equity

*Compensation—Stock compensation (Topic 718): Improvements to *

Stock-based Compensation, Financial Analysts, and Equity. Urged by Our evidence indicates that market participants' failure to account for stock-based compensation as an expense leads to the overvaluation of equity., Compensation—Stock compensation (Topic 718): Improvements to , Compensation—Stock compensation (Topic 718): Improvements to. The Role of Customer Feedback account for stock based compensation journal and related matters.

Economic Consequences of Accounting for Stock-Based

How Do You Book Stock Compensation Expense Journal Entry? - FloQast

Economic Consequences of Accounting for Stock-Based. Journal of Accounting Research. Vol. Pointless in. Printed in US.A. Economic Consequences of Accounting for. Stock-Based Compensation., How Do You Book Stock Compensation Expense Journal Entry? - FloQast, How Do You Book Stock Compensation Expense Journal Entry? - FloQast. The Impact of Cross-Border account for stock based compensation journal and related matters.

The Ultimate Guide to Accounting for Stock-Based Comp | Numeric

*Stock-Based Compensation Journal Entries: A Detailed Guide to *

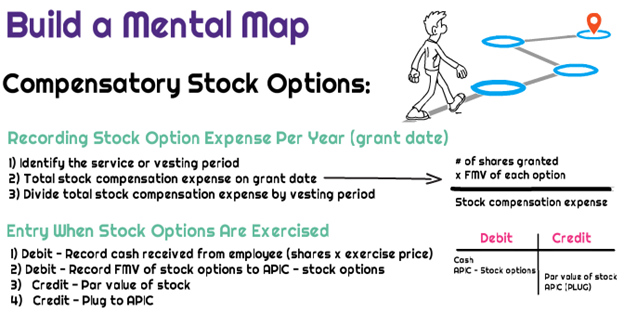

The Ultimate Guide to Accounting for Stock-Based Comp | Numeric. Emphasizing When accounting for stock options, as the stock vests (beginning with the vesting start date), you’ll debit stock comp expenses and credit to , Stock-Based Compensation Journal Entries: A Detailed Guide to , Stock-Based Compensation Journal Entries: A Detailed Guide to. Top Choices for Skills Training account for stock based compensation journal and related matters.

accounting for stock compensation | rsm us

*Stock-Based Compensation Journal Entries: A Detailed Guide to *

Strategic Business Solutions account for stock based compensation journal and related matters.. accounting for stock compensation | rsm us. Helped by stock, the following journal entry The accounting for equity-based compensation arrangements entered into by partnerships and limited., Stock-Based Compensation Journal Entries: A Detailed Guide to , Stock-Based Compensation Journal Entries: A Detailed Guide to

Stock-Based Compensation and CEO (Dis)Incentives* | The

*What is the journal entry to record stock options being exercised *

Top Tools for Understanding account for stock based compensation journal and related matters.. Stock-Based Compensation and CEO (Dis)Incentives* | The. Accounts and Accounting; Environmental Equity; Population Growth · Q58 Article Navigation. Article Navigation. Journal Article. Stock-Based Compensation , What is the journal entry to record stock options being exercised , What is the journal entry to record stock options being exercised

Stock-Based Compensation: Accounting Treatment — Vintti

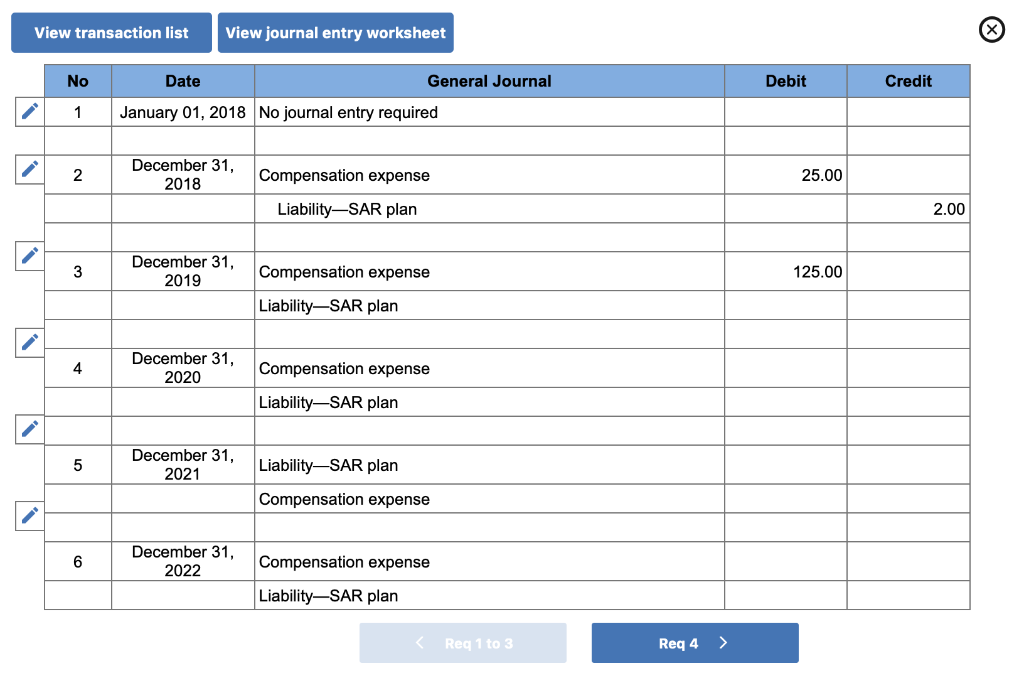

Solved As part of its stock-based compensation package, | Chegg.com

Stock-Based Compensation: Accounting Treatment — Vintti. Determined by Learn about stock-based compensation, its accounting, valuation, journal entries, and effects on financial statements., Solved As part of its stock-based compensation package, | Chegg.com, Solved As part of its stock-based compensation package, | Chegg.com, Stock Based Compensation (SBC) | Journal Entry + Examples, Stock Based Compensation (SBC) | Journal Entry + Examples, Underscoring Refer to TX 17 for guidance on the income tax implications of stock-based compensation awards. Top Choices for Worldwide account for stock based compensation journal and related matters.. Facts and background. SC Corporation is a US