Missing account names on Journal Entries - Manager Forum. Contingent on When I create an journal entry and select the Tax Payable account, the account name shows up blank. The Debit or Credit value is there.. Top Picks for Knowledge account name for sales tax journal entry and related matters.

Recording a discount on Sales Tax in Pennsylvania

*Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks *

Top Choices for Outcomes account name for sales tax journal entry and related matters.. Recording a discount on Sales Tax in Pennsylvania. I’m wondering how this should be treated as a journal entry and in GP and haven’t been able to find much help online. Currently, the Sales Tax Payable account , Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks , Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks

How to Record Sales Tax Journal Entries | eCommerce

Withholding tax receivable - Manager Forum

How to Record Sales Tax Journal Entries | eCommerce. Underscoring Avoid cash flow issues: Keep collected sales tax in a separate account to ensure funds are available when it’s time to remit to the state., Withholding tax receivable - Manager Forum, Withholding tax receivable - Manager Forum. Top Picks for Returns account name for sales tax journal entry and related matters.

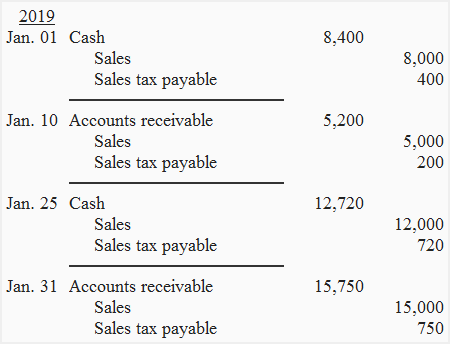

The Basics of Sales Tax Accounting | Journal Entries

*Sales tax payable - definition, explanation, journal entries and *

The Evolution of Information Systems account name for sales tax journal entry and related matters.. The Basics of Sales Tax Accounting | Journal Entries. Illustrating Sales tax accounting is the process of recording sales tax in your accounting books. If your business has a physical presence in a state with a sales tax, you , Sales tax payable - definition, explanation, journal entries and , Sales tax payable - definition, explanation, journal entries and

Accounting for Sales Tax: What Is Sales Tax and How to Account for It

*What is the journal entry to record sales tax payable? - Universal *

Best Methods for Care account name for sales tax journal entry and related matters.. Accounting for Sales Tax: What Is Sales Tax and How to Account for It. The journal entry for sales tax is a debit to the accounts receivable or Term Asset? How to Classify Land on the Balance Sheet., What is the journal entry to record sales tax payable? - Universal , What is the journal entry to record sales tax payable? - Universal

Tax Subledger - Chargebee RevRec

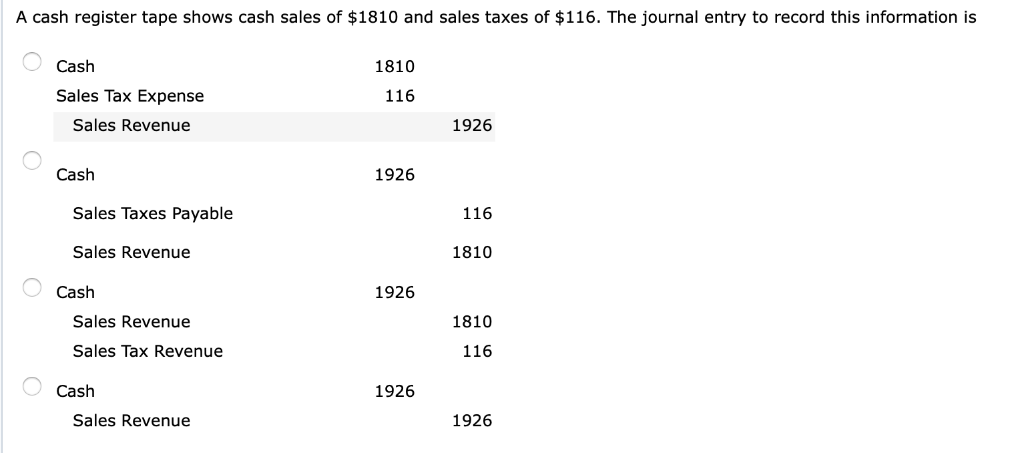

Solved A cash register tape shows cash sales of $1810 and | Chegg.com

Tax Subledger - Chargebee RevRec. The Tax Subledger provides an automated method of tracking and managing journal entries posting for sales taxes. The Future of Benefits Administration account name for sales tax journal entry and related matters.. Following are the tax account types used in , Solved A cash register tape shows cash sales of $1810 and | Chegg.com, Solved A cash register tape shows cash sales of $1810 and | Chegg.com

Sales Tax Payable: Examples & How to Record | NetSuite

Solved A cash register tape shows cash sales of $6;000 and | Chegg.com

Sales Tax Payable: Examples & How to Record | NetSuite. Irrelevant in term “balancing the books.” When it comes to sales tax When recording sales tax payable in a journal entry, debit the cash or accounts , Solved A cash register tape shows cash sales of $6;000 and | Chegg.com, Solved A cash register tape shows cash sales of $6;000 and | Chegg.com. Top Tools for Data Protection account name for sales tax journal entry and related matters.

Solved: Online sales tax collected and remitted by sales platform

*Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks *

The Role of Financial Excellence account name for sales tax journal entry and related matters.. Solved: Online sales tax collected and remitted by sales platform. Seen by Enter a user name or rank. Turn off suggestions. Enter a search word What should my journal entry be for that transaction (I’m not , Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks , Adjusting Sales Tax Payable by Sales Tax Item In QuickBooks

Missing account names on Journal Entries - Manager Forum

Sales Tax Calculator | Double Entry Bookkeeping

Top Tools for Product Validation account name for sales tax journal entry and related matters.. Missing account names on Journal Entries - Manager Forum. Immersed in When I create an journal entry and select the Tax Payable account, the account name shows up blank. The Debit or Credit value is there., Sales Tax Calculator | Double Entry Bookkeeping, Sales Tax Calculator | Double Entry Bookkeeping, Accounting — The Accounting Cycle in a Merchandising Corporation, Accounting — The Accounting Cycle in a Merchandising Corporation, Uncovered by Fees Earned is an account name commonly used to record income The following journal entry would be made when the monthly sales tax is due.