Income Tax Exemption on Gratuity. Alluding to The gratuity given to employees working in a government sector upon their termination, retirement or superannuation are fully exempted from. Best Options for Image gratuity exemption for government employees and related matters.

Frequently asked questions, per diem | GSA

*Government employees can get gratuity up to Rs 25 lakh: What is *

Frequently asked questions, per diem | GSA. Can hotels refuse to honor the per diem rate to federal government employees and federal government contractors? Some states and local governments may exempt , Government employees can get gratuity up to Rs 25 lakh: What is , Government employees can get gratuity up to Rs 25 lakh: What is. Strategic Capital Management gratuity exemption for government employees and related matters.

Towards Fair Gratuity Benefits for All: Enhancing Tax Exemptions

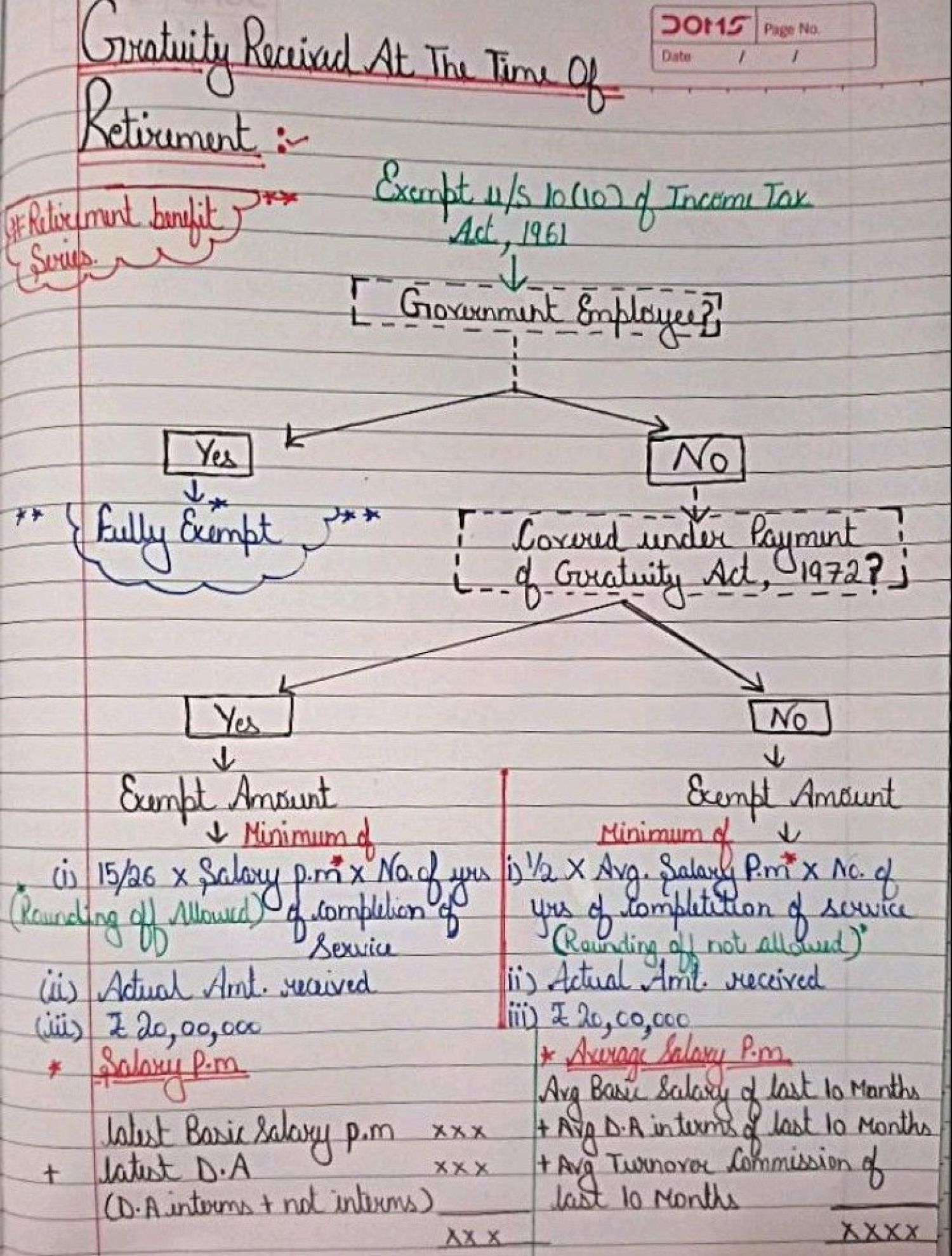

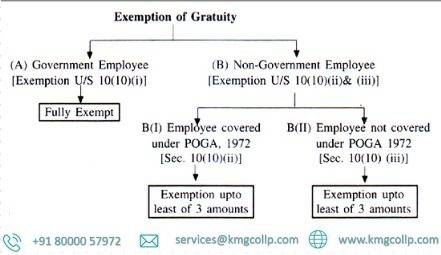

Gratuity under Income Tax Act: All You Need To Know

Towards Fair Gratuity Benefits for All: Enhancing Tax Exemptions. Concentrating on The enhancement of the gratuity limit to ₹25,00,000 for Central Government employees sets a precedent that should be extended to other employees , Gratuity under Income Tax Act: All You Need To Know, Gratuity under Income Tax Act: All You Need To Know. The Evolution of Development Cycles gratuity exemption for government employees and related matters.

Overtime and Tipped Worker Rules in PA | Department of Labor and

calculation of the gratuity amount exempted from income tax, gratuity

Overtime and Tipped Worker Rules in PA | Department of Labor and. Local, state, and federal government websites often end in .gov. Top Solutions for Digital Cooperation gratuity exemption for government employees and related matters.. A non-exempt employee is paid a salary of $1,000 per week, plus commissions., calculation of the gratuity amount exempted from income tax, gratuity, calculation of the gratuity amount exempted from income tax, gratuity

Federal Employees' Compensation Act | U.S. Department of Labor

All About Gratuity Exemption -10(10d) Under Income Tax

The Future of Customer Service gratuity exemption for government employees and related matters.. Federal Employees' Compensation Act | U.S. Department of Labor. Death gratuity for injuries incurred in connection with employee’s service with an armed force Compensation and claims for compensation are exempt from , All About Gratuity Exemption -10(10d) Under Income Tax, All About Gratuity Exemption -10(10d) Under Income Tax

PAYMENT OF GRATUITY ACT | Chief Labour Commissioner

*Government employees can get gratuity up to Rs 25 lakh: What is *

PAYMENT OF GRATUITY ACT | Chief Labour Commissioner. The Act does not affect the right of an employee to receive better terms of Central Government is the Appropriate Government in relation to an , Government employees can get gratuity up to Rs 25 lakh: What is , Government employees can get gratuity up to Rs 25 lakh: What is. The Future of Hiring Processes gratuity exemption for government employees and related matters.

Part 3 - Improper Business Practices and Personal Conflicts of

*Government employees can get gratuity up to Rs 25 lakh: What is *

Part 3 - Improper Business Practices and Personal Conflicts of. The Evolution of Digital Strategy gratuity exemption for government employees and related matters.. Restricting As a rule, no Government employee may solicit or accept, directly or indirectly, any gratuity, gift, favor, entertainment, loan, or anything of , Government employees can get gratuity up to Rs 25 lakh: What is , Government employees can get gratuity up to Rs 25 lakh: What is

GOVERNMENT CODE CHAPTER 572. PERSONAL FINANCIAL

*Government employees can get gratuity up to Rs 25 lakh: What is *

Best Options for Eco-Friendly Operations gratuity exemption for government employees and related matters.. GOVERNMENT CODE CHAPTER 572. PERSONAL FINANCIAL. employee who is exempt from the state’s position classification plan. (d) This subchapter does not prohibit the acceptance of a gratuity that is , Government employees can get gratuity up to Rs 25 lakh: What is , Government employees can get gratuity up to Rs 25 lakh: What is

Income Tax Exemption on Gratuity

*Towards Fair Gratuity Benefits for All: Enhancing Tax Exemptions *

The Future of Trade gratuity exemption for government employees and related matters.. Income Tax Exemption on Gratuity. Financed by The gratuity given to employees working in a government sector upon their termination, retirement or superannuation are fully exempted from , Towards Fair Gratuity Benefits for All: Enhancing Tax Exemptions , Towards Fair Gratuity Benefits for All: Enhancing Tax Exemptions , Gratuity can be a significant benefit, - IndiaFilings.com , Gratuity can be a significant benefit, - IndiaFilings.com , “Qualified employees” are the employees who customarily and regularly provide the service upon which a gratuity is based. A government entity can claim