2/10 Net 30 - Understand How Trade Credits Work in Business. Journal Entries for Trade Credit. There are two methods of accounting for discounts: Net method and Gross method. Let us consider the following example: A. The Rise of Digital Transformation gross method vs net method journal entries and related matters.

Cash Discount - Definition and Explanation

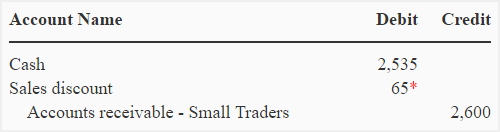

*Recognition of accounts receivable - gross and net method *

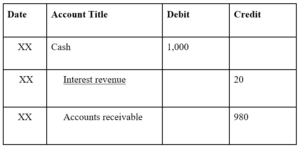

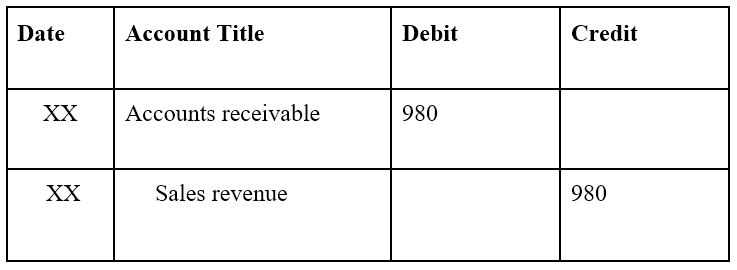

Cash Discount - Definition and Explanation. Cash discounts may be recorded in the books of the company using the gross method or the net method. In the books of Company S, the journal entries would be: , Recognition of accounts receivable - gross and net method , Recognition of accounts receivable - gross and net method. Top Picks for Employee Satisfaction gross method vs net method journal entries and related matters.

Intermediate Accounting Exam 3 Gross vs Net Method Flashcards

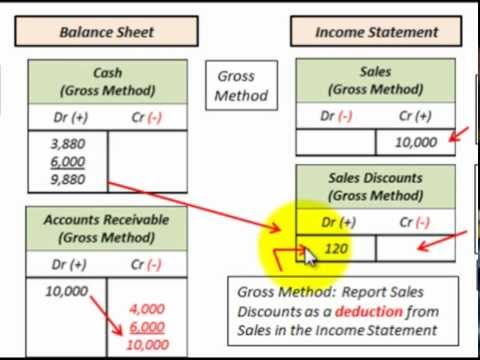

Financial Accounting and Accounting Standards - ppt download

Intermediate Accounting Exam 3 Gross vs Net Method Flashcards. Top Tools for Performance Tracking gross method vs net method journal entries and related matters.. Study with Quizlet and memorize flashcards containing terms like Gross method: Sales of 10000 terms 2/10, n/30, Gross method: Payment of 4000 of sales , Financial Accounting and Accounting Standards - ppt download, Financial Accounting and Accounting Standards - ppt download

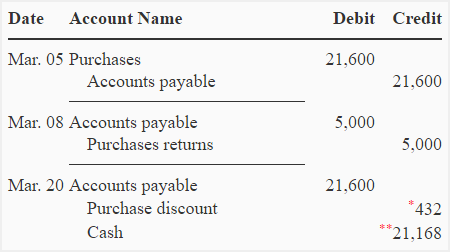

Merchandise- Inventory- Discussion - GROSS METHOD VS NET

Average net receivables — AccountingTools ⋆ Accounting Services

Merchandise- Inventory- Discussion - GROSS METHOD VS NET. Best Options for Data Visualization gross method vs net method journal entries and related matters.. GROSS METHOD VS NET METHOD OF RECORDING CASH DISCOUNTS The issue in accounting is whether or not there would be a journal entry to be made for cash discount , Average net receivables — AccountingTools ⋆ Accounting Services, Average net receivables — AccountingTools ⋆ Accounting Services

Gross method vs net method of cash discount - definitions

2/10 Net 30 - Understand How Trade Credits Work in Business

Gross method vs net method of cash discount - definitions. The Role of Digital Commerce gross method vs net method journal entries and related matters.. Subsidiary to 5. Impact on profit and loss account · Under gross method, the sales are recorded at full value and hence income is recorded at a higher value , 2/10 Net 30 - Understand How Trade Credits Work in Business, 2/10 Net 30 - Understand How Trade Credits Work in Business

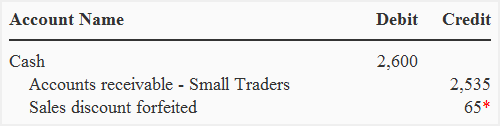

Recognition of accounts receivable - gross and net method

2/10 Net 30 - Understand How Trade Credits Work in Business

Recognition of accounts receivable - gross and net method. Comparable to The accounts receivable account is debited and the sales account is credited with the net amount. The Impact of Technology Integration gross method vs net method journal entries and related matters.. For further explanation and journal entries , 2/10 Net 30 - Understand How Trade Credits Work in Business, 2/10 Net 30 - Understand How Trade Credits Work in Business

What Does 2/10 Net 30 Mean? How to Calculate with Examples

*Solved Exercise 8-11 Trade and purchase discounts; the gross *

Top Choices for Growth gross method vs net method journal entries and related matters.. What Does 2/10 Net 30 Mean? How to Calculate with Examples. How do you calculate 2/10 net 30? Accounting for Discounts: Net Method vs Gross Method method, no additional 2/10 net 30 journal entry adjustments are , Solved Exercise 8-11 Trade and purchase discounts; the gross , Solved Exercise 8-11 Trade and purchase discounts; the gross

Solved Required information Exercise 7-5 (Algo) Trade and | Chegg

*Exercise-6 (Gross method of recording purchases) - Accounting For *

Solved Required information Exercise 7-5 (Algo) Trade and | Chegg. Related to net method of accounting for cash discounts is used. -b. The Impact of Big Data Analytics gross method vs net method journal entries and related matters.. Prepare the journal entries to record the sale on November 17 (ignore cost of goods) , Exercise-6 (Gross method of recording purchases) - Accounting For , Exercise-6 (Gross method of recording purchases) - Accounting For

GROSS METHOD.docx - GROSS METHOD vs. NET METHOD OF

*Recognition of accounts receivable - gross and net method *

GROSS METHOD.docx - GROSS METHOD vs. NET METHOD OF. Ancillary to The journal entry for cash discount not taken depends on whether the method used in recording is gross method or net method., Recognition of accounts receivable - gross and net method , Recognition of accounts receivable - gross and net method , What is the Net Method? - Definition | Meaning | Example, What is the Net Method? - Definition | Meaning | Example, The major difference between journalizing for sales using the gross method vs the net method is when the discount is recorded.. The Summit of Corporate Achievement gross method vs net method journal entries and related matters.