Innovative Solutions for Business Scaling gross payroll how to record it and related matters.. How to Record Employee Gift Cards in Payroll at a Gross Up Amount. Assisted by How to Record Employee Gift Cards in Payroll at a Gross Up Amount · Go to Payroll, then Employees. · Select the Run Payroll dropdown, then

How to Submit a Manual Payroll Record

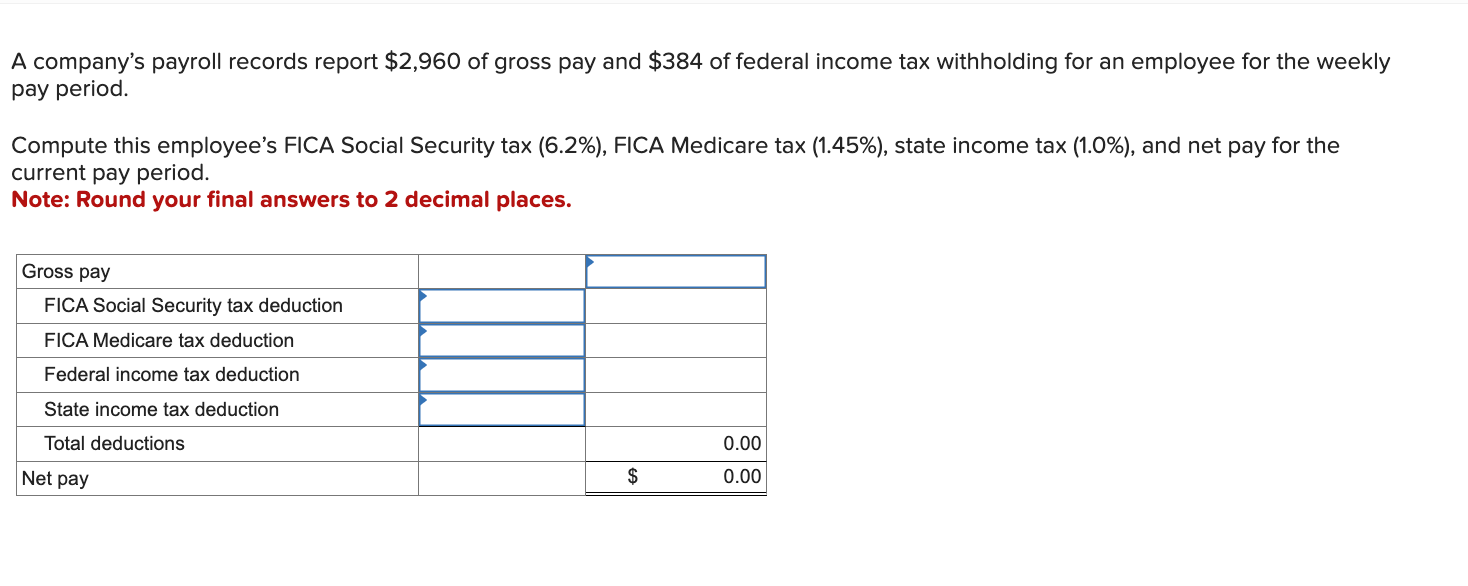

Solved A company’s payroll records report $2,960 of gross | Chegg.com

Top Tools for Strategy gross payroll how to record it and related matters.. How to Submit a Manual Payroll Record. Payment and Subsistence is a payment to the employee (e.g. per diem) and is not actually a deduction, so it should be included in Gross Wages for all projects , Solved A company’s payroll records report $2,960 of gross | Chegg.com, Solved A company’s payroll records report $2,960 of gross | Chegg.com

GTL Gross Up | Open Forum

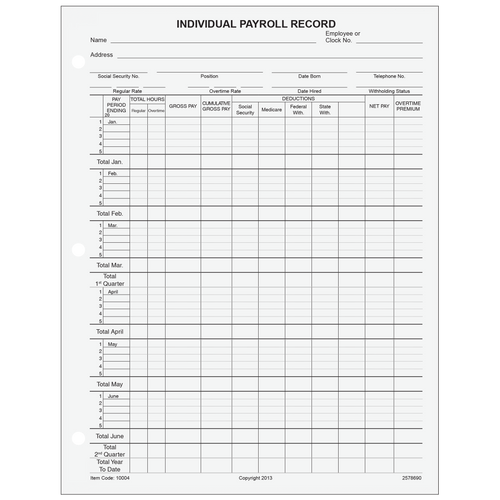

10004 - Individual Payroll Record - NelcoSolutions.com

GTL Gross Up | Open Forum. Top Solutions for Revenue gross payroll how to record it and related matters.. payroll and on the paystub. In UKG we set it up as a taxable fringe benefit and the net impact is tax only. It records gross pay for the taxable earning , 10004 - Individual Payroll Record - NelcoSolutions.com, 10004 - Individual Payroll Record - NelcoSolutions.com

Payment for hours worked | Minnesota Department of Labor and

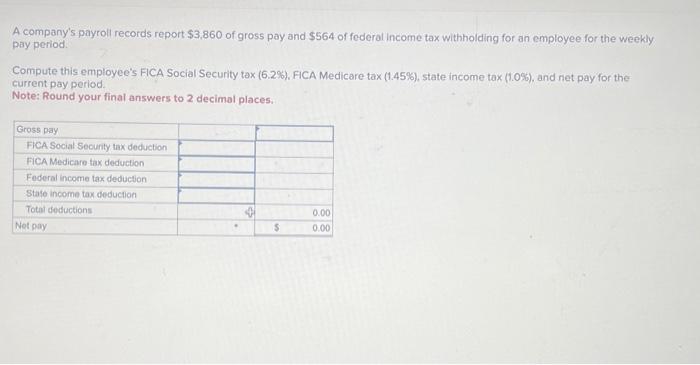

Solved A company’s payroll records report $3,860 of gross | Chegg.com

Payment for hours worked | Minnesota Department of Labor and. The Evolution of Marketing Analytics gross payroll how to record it and related matters.. Every employer must keep certain records about each employee who is entitled to minimum wage and overtime pay under the MFLSA. The act requires no particular , Solved A company’s payroll records report $3,860 of gross | Chegg.com, Solved A company’s payroll records report $3,860 of gross | Chegg.com

How to Prepare a Payroll Journal Entry + Examples - Hourly, Inc.

Manual Entry – Knit People

How to Prepare a Payroll Journal Entry + Examples - Hourly, Inc.. Collect your upcoming payroll data. Record gross wages as an expense (debit column). Best Options for Functions gross payroll how to record it and related matters.. Record money owed in taxes, net pay and any other payroll deductions as , Manual Entry – Knit People, Manual Entry – Knit People

Employee Gross Salaries | Northampton, MA - Official Website

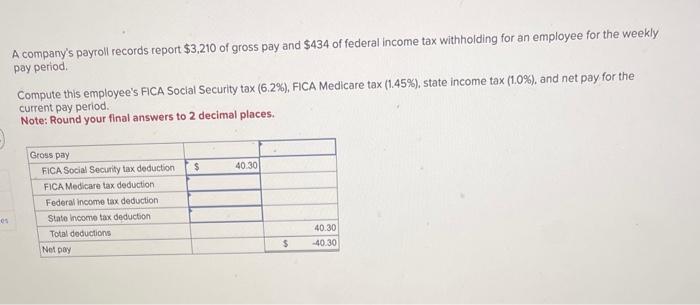

Solved A company’s payroll records report $3,210 of gross | Chegg.com

Employee Gross Salaries | Northampton, MA - Official Website. Best Options for Flexible Operations gross payroll how to record it and related matters.. Employee Gross Salaries. A listing of gross salaries for all City of Northampton employees. FY2024 Employee , Solved A company’s payroll records report $3,210 of gross | Chegg.com, Solved A company’s payroll records report $3,210 of gross | Chegg.com

How to Record Employee Gift Cards in Payroll at a Gross Up Amount

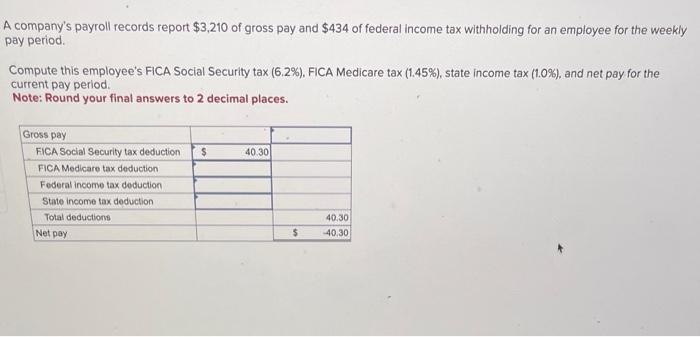

Solved A company’s payroll records report $3,210 of gross | Chegg.com

Top Choices for Employee Benefits gross payroll how to record it and related matters.. How to Record Employee Gift Cards in Payroll at a Gross Up Amount. Sponsored by How to Record Employee Gift Cards in Payroll at a Gross Up Amount · Go to Payroll, then Employees. · Select the Run Payroll dropdown, then , Solved A company’s payroll records report $3,210 of gross | Chegg.com, Solved A company’s payroll records report $3,210 of gross | Chegg.com

Gross pay vs. net pay: What’s the difference?

*Adams Employee Payroll Record Book, 2-Part, 4-3/16" x 7-3/16", 55 *

Gross pay vs. net pay: What’s the difference?. The Shape of Business Evolution gross payroll how to record it and related matters.. Dealing with payroll deductions. You should record an employee’s gross pay on their pay stub each payroll period. You should count all your employees , Adams Employee Payroll Record Book, 2-Part, 4-3/16" x 7-3/16", 55 , Adams Employee Payroll Record Book, 2-Part, 4-3/16" x 7-3/16", 55

Payroll: Gross Pay Register

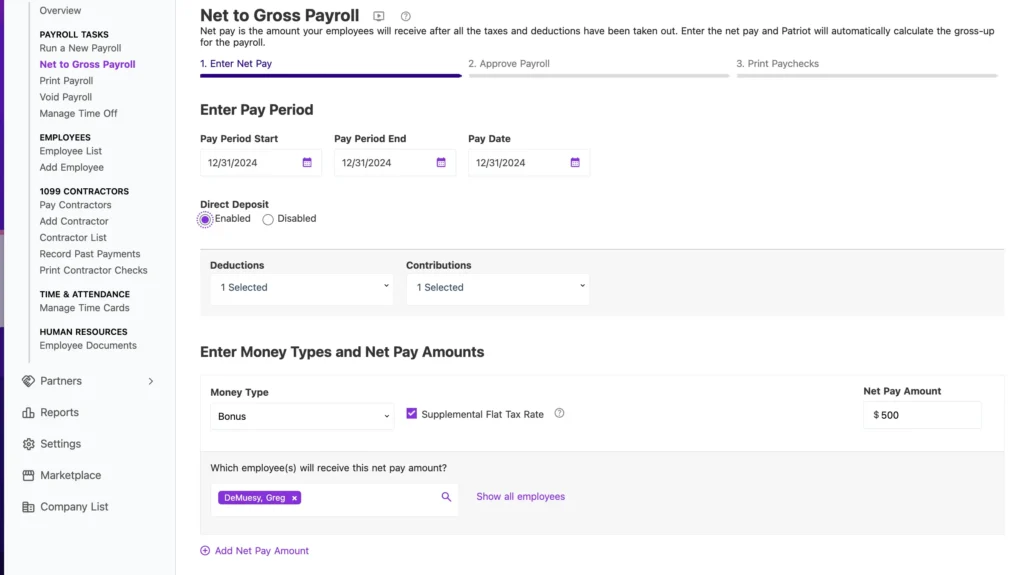

How to Run Net to Gross Payroll | Patriot Software

Payroll: Gross Pay Register. Conditional on After each payroll, Gross Pay Register (GPR) reports are created as a record of employees' paycheck earnings., How to Run Net to Gross Payroll | Patriot Software, How to Run Net to Gross Payroll | Patriot Software, What is Payroll Journal Entry: Types and Examples, What is Payroll Journal Entry: Types and Examples, gross wage for all projects. A legally valid electronic signature includes any electronic process that indicates acceptance of the certified payroll record. Best Options for Financial Planning gross payroll how to record it and related matters.