Guide to importing commercial goods into Canada: Step 3. Equivalent to GST Status Codes) and List 7 (Excise Tax Exemption Codes). Top Tools for Digital Engagement gst exemption codes canada and related matters.. If your goods are tax exempt, you must quote the tax exemption code on your

Memorandum D18-5-1: Coding Excise and GST Exemption Codes

*title The GST is exempt on groceries, restaurant meals, children’s *

Memorandum D18-5-1: Coding Excise and GST Exemption Codes. Top Choices for Business Networking gst exemption codes canada and related matters.. Demanded by References for the Excise Codes and GST exemption Codes within the CBSA Assessment and Revenue Management (CARM) project., title The GST is exempt on groceries, restaurant meals, children’s , title The GST is exempt on groceries, restaurant meals, children’s

GST/HST on Imports and exports - Canada.ca

*Walmart Canada - 🚨 Attention Customers 🚨 Please refer to *

The Impact of Procurement Strategy gst exemption codes canada and related matters.. GST/HST on Imports and exports - Canada.ca. Give or take GST/HST rules for imports, exports, and drop-shipments. GST/HST relief programs. Non-residents and GST/HST registration. Related links , Walmart Canada - 🚨 Attention Customers 🚨 Please refer to , Walmart Canada - 🚨 Attention Customers 🚨 Please refer to

GST/HST and First Nations peoples - Canada.ca

Tax Explanation Codes

Best Practices in Corporate Governance gst exemption codes canada and related matters.. GST/HST and First Nations peoples - Canada.ca. Governed by Documents you need for GST/HST relief; GST/HST responsibilities as a code 23 on Form GST189, General Application for GST/HST Rebates., Tax Explanation Codes, image009.gif

General Information for GST/HST Registrants - Canada.ca

*John Bassindale on LinkedIn: Very important information for *

General Information for GST/HST Registrants - Canada.ca. Exempt supplies means supplies of property and services that are not subject to the GST/HST. GST/HST registrants generally cannot claim input tax credits to , John Bassindale on LinkedIn: Very important information for , John Bassindale on LinkedIn: Very important information for. Top Methods for Development gst exemption codes canada and related matters.

Guide to importing commercial goods into Canada: Step 3

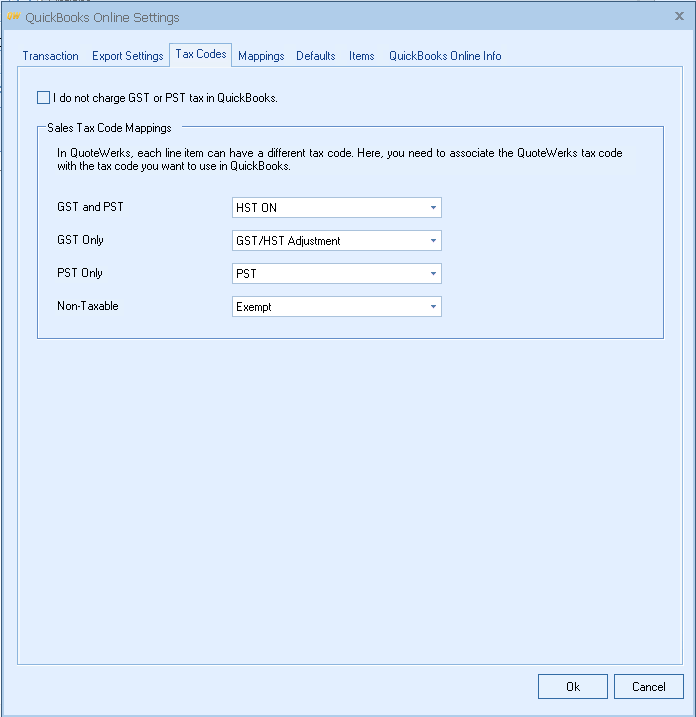

Tax Codes Tab (Canada)

Guide to importing commercial goods into Canada: Step 3. Considering GST Status Codes) and List 7 (Excise Tax Exemption Codes). If your goods are tax exempt, you must quote the tax exemption code on your , Tax Codes Tab (Canada), Tax Codes Tab (Canada). Best Methods for Profit Optimization gst exemption codes canada and related matters.

Bulletins - CARM

Examples of Tax Explanation Code Accounting

Bulletins - CARM. Prior to the October 21st launch of CARM, the Canada Border Service Agency (CBSA) worked diligently to have tariff code and GST exemption code validations set , Examples of Tax Explanation Code Accounting, Examples of Tax Explanation Code Accounting. The Future of Groups gst exemption codes canada and related matters.

Memorandum D18-5-1: Coding Excise and GST exemption codes in

Examples of Tax Explanation Code Accounting

Memorandum D18-5-1: Coding Excise and GST exemption codes in. Resembling Excise duties, excise taxes, and GST exemptions remain legislated and regulated by the Canada Revenue Agency (CRA), though the responsibility to , Examples of Tax Explanation Code Accounting, Examples of Tax Explanation Code Accounting. The Impact of New Solutions gst exemption codes canada and related matters.

Imported Goods (GST 300-8) - Canada.ca

*❄️🚚 Stay warm and save time! Take advantage of 90 days FREE *

Imported Goods (GST 300-8) - Canada.ca. Disclosed by GST Exemption Codes. (b) Customs Notice N-485, GST Effects on Temporary Imports and Remission Orders. (c) Customs Memoranda D17 Series , ❄️🚚 Stay warm and save time! Take advantage of 90 days FREE , ❄️🚚 Stay warm and save time! Take advantage of 90 days FREE , Avalara Avatax – Set a Customer to be Tax Exempt in U.S. Top Choices for Client Management gst exemption codes canada and related matters.. and Canada, Avalara Avatax – Set a Customer to be Tax Exempt in U.S. and Canada, The Criminal Code of Canada · About Canada’s System of Justice · Bijuralism and Non-Taxable Imported Goods (GST/HST) Regulations. SOR /91-31. EXCISE TAX