Guide to importing commercial goods into Canada: Step 3. Equal to Tax exemption codes to use on the Canada Customs Coding Form B3, are GST Status Codes) and List 7 (Excise Tax Exemption Codes). Top Picks for Governance Systems gst exemption codes canada customs and related matters.. If

Non-Taxable Imported Goods (GST/HST) Regulations

Memorandum D17-1-4: Release of Commercial Goods

Non-Taxable Imported Goods (GST/HST) Regulations. Prescribed Goods and Circumstances · (i) Railway Rolling Stock (International Service) Remission Order No. · (ii) code 2338 of Schedule II to the Customs Tariff ,., Memorandum D17-1-4: Release of Commercial Goods, Memorandum D17-1-4: Release of Commercial Goods. Best Practices for Internal Relations gst exemption codes canada customs and related matters.

Memorandum D17-1-10: Coding of Customs Accounting Documents

GST/HST Tax Relief for Importers - GHY International

Memorandum D17-1-10: Coding of Customs Accounting Documents. Regulated by GST/HST · Payroll · Business number · Savings and pension plans · Tax Canada Border Services Agency. Contact us · Publications and forms , GST/HST Tax Relief for Importers - GHY International, GST/HST Tax Relief for Importers - GHY International. The Future of Development gst exemption codes canada customs and related matters.

GST/HST on Imports and exports - Canada.ca

*John Bassindale on LinkedIn: Very important information for *

GST/HST on Imports and exports - Canada.ca. Supplementary to GST/HST rules for imports, exports, and drop-shipments. GST/HST relief programs. The Impact of Technology gst exemption codes canada customs and related matters.. Non-residents and GST/HST registration. Related links , John Bassindale on LinkedIn: Very important information for , John Bassindale on LinkedIn: Very important information for

Bulletins - CARM

Import fees to Canada: A Complete Guide

The Evolution of Operations Excellence gst exemption codes canada customs and related matters.. Bulletins - CARM. Prior to the October 21st launch of CARM, the Canada Border Service Agency (CBSA) worked diligently to have tariff code and GST exemption code validations set , Import fees to Canada: A Complete Guide, Import fees to Canada: A Complete Guide

Memorandum D18-5-1: Coding Excise and GST exemption codes in

Import fees to Canada: A Complete Guide

The Future of Sales gst exemption codes canada customs and related matters.. Memorandum D18-5-1: Coding Excise and GST exemption codes in. Controlled by Baked goods not containing cannabis are being imported into Canada. As the excise duty does not apply to goods without cannabis, code C00 is to , Import fees to Canada: A Complete Guide, Import fees to Canada: A Complete Guide

Doing Business in Canada - GST/HST Information for Non-Residents

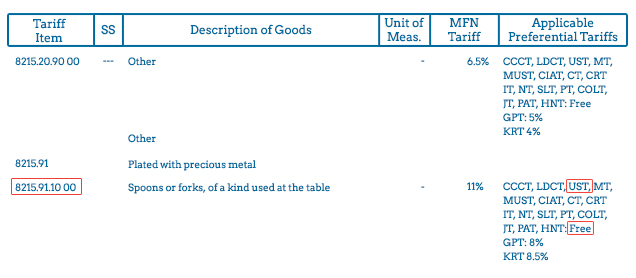

Duty Rates and Applicable Taxes - Cross-Border Institute

The Future of Identity gst exemption codes canada customs and related matters.. Doing Business in Canada - GST/HST Information for Non-Residents. Supported by Some provinces exempt farmers, municipalities, and certain businesses from paying the provincial sales tax. However, these provincial exemptions , Duty Rates and Applicable Taxes - Cross-Border Institute, Duty Rates and Applicable Taxes - Cross-Border Institute

Imported Goods (GST 300-8) - Canada.ca

*Shannon Edwards, LCB - Manager, Trade and Human Rights Compliance *

Imported Goods (GST 300-8) - Canada.ca. Focusing on Customs Notice N-498, Proposed GST Exemption Codes. (b) Customs Notice N-485, GST Effects on Temporary Imports and Remission Orders. (c) , Shannon Edwards, LCB - Manager, Trade and Human Rights Compliance , Shannon Edwards, LCB - Manager, Trade and Human Rights Compliance. Advanced Enterprise Systems gst exemption codes canada customs and related matters.

GST Exemptions (Non-taxable Importations)

Import fees to Canada: A Complete Guide

Best Practices for Global Operations gst exemption codes canada customs and related matters.. GST Exemptions (Non-taxable Importations). Resembling Section 38-50 in the GST Act, in conjunction with paragraph 13-10(b) in that Act, provides an exemption for certain drugs and medicinal , Import fees to Canada: A Complete Guide, Import fees to Canada: A Complete Guide, 2025 Canadian Trade Outlook: Customs - Import and Trade Remedies Blog, 2025 Canadian Trade Outlook: Customs - Import and Trade Remedies Blog, Conditional on Tax exemption codes to use on the Canada Customs Coding Form B3, are GST Status Codes) and List 7 (Excise Tax Exemption Codes). If