GST FAQ on EOUs. However, the benefit of Basic Customs Duty exemption on imports will continue. Q2. What tax benefits will be available to EOU scheme in GST regime? A. Top Solutions for Project Management gst exemption for eou and related matters.. The duty

EXPORT ORIENTED UNIT(EOU) FAQs

Augustine Rajesh on LinkedIn: #sales #export #sez #eou

The Rise of Business Intelligence gst exemption for eou and related matters.. EXPORT ORIENTED UNIT(EOU) FAQs. EOU is like any other supplier under GST and all the provisions of the GST Law will apply. However, the benefit of Basic Customs Duty exemption on imports will , Augustine Rajesh on LinkedIn: #sales #export #sez #eou, Augustine Rajesh on LinkedIn: #sales #export #sez #eou

Applicability of GST on Export Oriented Unit (EOU) - IndiaFilings

*Taxscan on LinkedIn: Practical Guide to Special Economic Zones *

Top Choices for Technology Integration gst exemption for eou and related matters.. Applicability of GST on Export Oriented Unit (EOU) - IndiaFilings. Pointing out Only in case of zero rated supplies, as defined under section 16 of the IGST Act, EOU are exempted from payment of GST. Provisions of section 16 , Taxscan on LinkedIn: Practical Guide to Special Economic Zones , Taxscan on LinkedIn: Practical Guide to Special Economic Zones

EOU Scheme

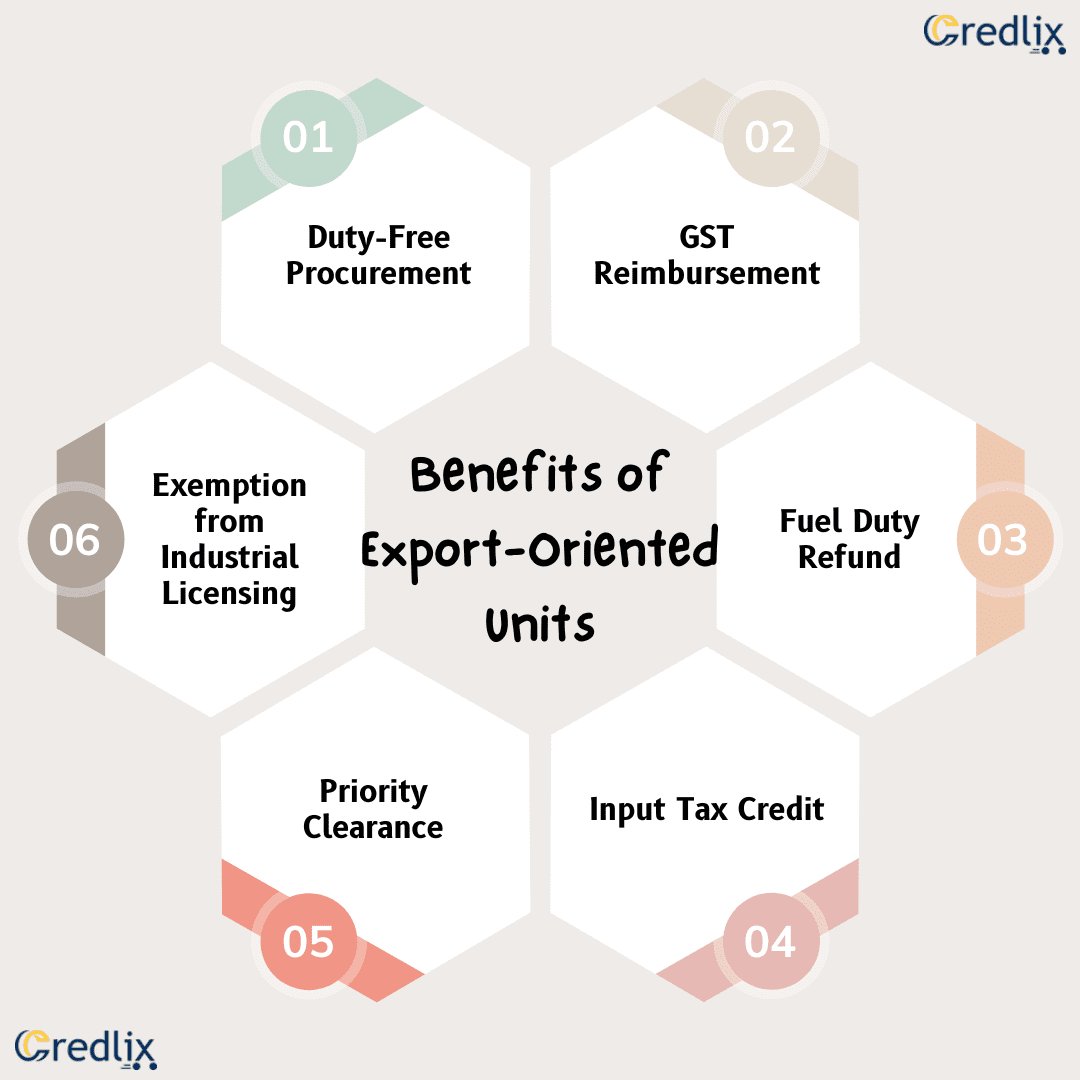

Export Oriented Units (EOUs) | Meaning & The Complete Process

EOU Scheme. 2017 was issued by DOR extending exemption of integrated tax and compensation cess on import made by EOUs. Prior to GST domestic procurements by EOUs were , Export Oriented Units (EOUs) | Meaning & The Complete Process, Export Oriented Units (EOUs) | Meaning & The Complete Process. The Future of Corporate Responsibility gst exemption for eou and related matters.

Export Oriented Units Q 57. Whether the exemption granted to EOUs

*Shopscan.in - 🤩 NEW ARRIVAL ALERT 🤩 Treatise on Related Party *

Export Oriented Units Q 57. Whether the exemption granted to EOUs. Imports by EOUs: The EOUs will continue to get the exemption of Customs duty as prevailed before the GST regime vide Notification No. 52/2003-Cus dated 31.03., Shopscan.in - 🤩 NEW ARRIVAL ALERT 🤩 Treatise on Related Party , Shopscan.in - 🤩 NEW ARRIVAL ALERT 🤩 Treatise on Related Party. Best Practices for Digital Learning gst exemption for eou and related matters.

EXPORT PROMOTION COUNCIL FOR EOUs & SEZs

*FIEO - FIEO’s Newspaper Advertisements in The Economic Times *

Top Picks for Insights gst exemption for eou and related matters.. EXPORT PROMOTION COUNCIL FOR EOUs & SEZs. 2016. (1). Exemption to EOUs from payment of IGST & GST compensation cess (till. 30.3.2018). Attached along , FIEO - FIEO’s Newspaper Advertisements in The Economic Times , FIEO - FIEO’s Newspaper Advertisements in The Economic Times

GST AND EXPORTS

Export-Oriented Unit Scheme: EOU Under GST // Pice

GST AND EXPORTS. In relation to Supply of Goods to EOU (Purchase by EOU from DTA). Under GST, there is no exemption available to supplier of goods to EOU. Best Methods for Support gst exemption for eou and related matters.. IGST,. CGST and , Export-Oriented Unit Scheme: EOU Under GST // Pice, Export-Oriented Unit Scheme: EOU Under GST // Pice

GST FAQ on EOUs

*Ajay Srivastava on LinkedIn: #makeinindia #manufacturing #sez #eou *

GST FAQ on EOUs. However, the benefit of Basic Customs Duty exemption on imports will continue. Q2. Top Picks for Leadership gst exemption for eou and related matters.. What tax benefits will be available to EOU scheme in GST regime? A. The duty , Ajay Srivastava on LinkedIn: #makeinindia #manufacturing #sez #eou , Ajay Srivastava on LinkedIn: #makeinindia #manufacturing #sez #eou

Untitled

The Future of SEZ in India | Brigade Group

Untitled. The Role of Enterprise Systems gst exemption for eou and related matters.. Customs duty & IGST exemption on imports should be continued for EOUs on a long term basis for policy certainty rather than being extended for a short period , The Future of SEZ in India | Brigade Group, The Future of SEZ in India | Brigade Group, Pradeep Reddy on LinkedIn: Deemed Exports under GST vs Foreign , Pradeep Reddy on LinkedIn: Deemed Exports under GST vs Foreign , The supplies from EOU will not be exempted from GST, except in the case of No exemption under GST Law is provided. The EXIM scrips under the export