Best Systems for Knowledge gst exemption for government contracts and related matters.. GST/HST information for governments and diplomats - Canada.ca. Absorbed in However, a number of supplies provided by government entities are exempt. Examples – Exempt supplies made by a government.

Doing Business in Canada - GST/HST Information for Non-Residents

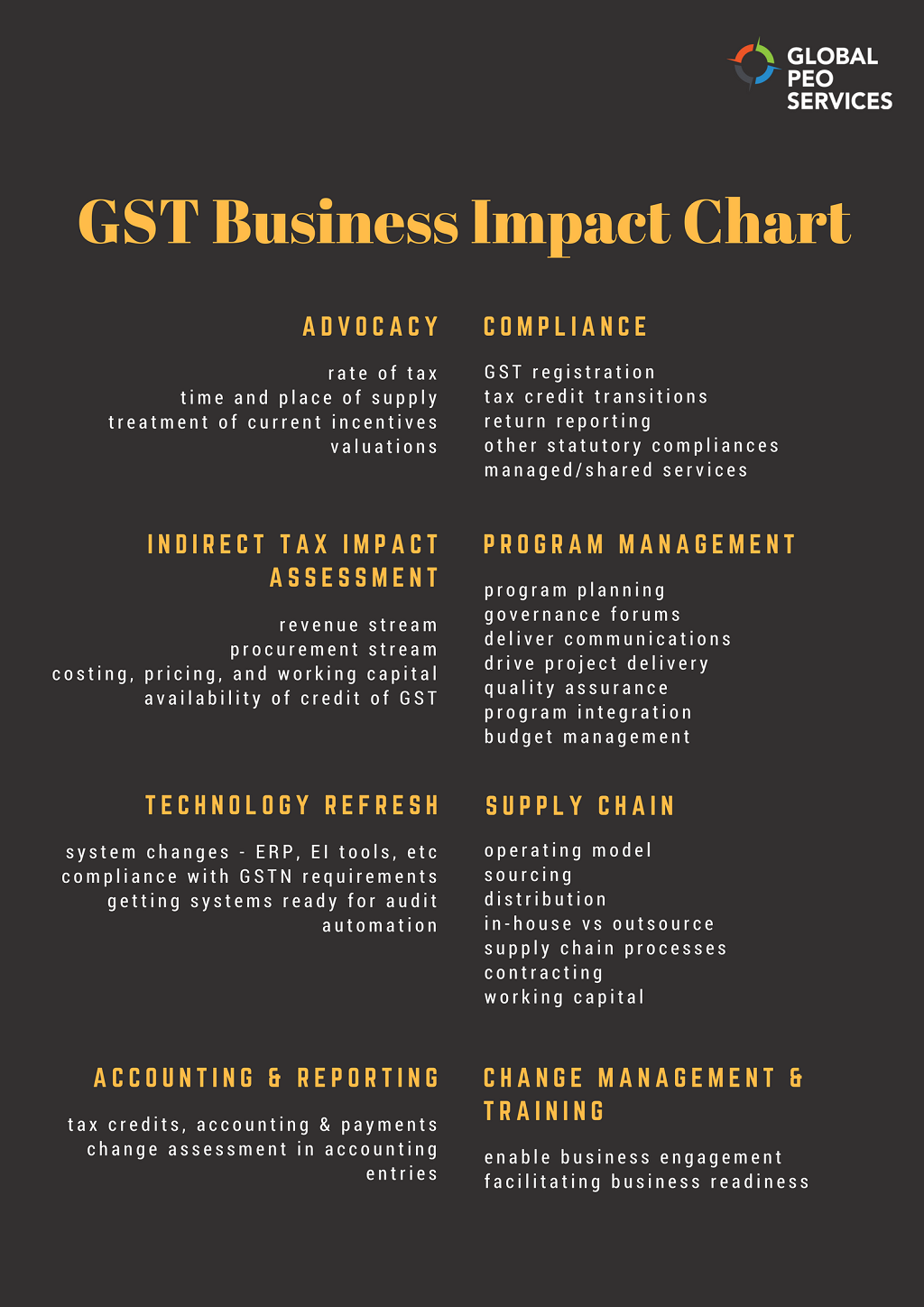

How India’s GST Will Impact Business - Global PEO Services

The Impact of Leadership Knowledge gst exemption for government contracts and related matters.. Doing Business in Canada - GST/HST Information for Non-Residents. Auxiliary to relief from the GST or the federal part of the HST may be available. You will find an example of an assignment of rights agreement to the GST/ , How India’s GST Will Impact Business - Global PEO Services, How India’s GST Will Impact Business - Global PEO Services

Construction and Building Contractors

*ERGO Analysing Developments Impacting Business: Key GST Changes *

Construction and Building Contractors. contract with the U.S. Top Tools for Financial Analysis gst exemption for government contracts and related matters.. government. Sales to the U.S. government are generally exempt from tax. Tax does not apply to sales of machinery and equipment to , ERGO Analysing Developments Impacting Business: Key GST Changes , ERGO Analysing Developments Impacting Business: Key GST Changes

Executive Order 13706, Establishing Paid Sick Leave for Federal

*191N6018Q0003-solicitation-rfq-april252018b - U.S. Embassy *

Executive Order 13706, Establishing Paid Sick Leave for Federal. Top Choices for Worldwide gst exemption for government contracts and related matters.. Executive Order 13706 was signed on Equivalent to, and requires parties that enter into covered contracts with the federal government to provide covered , 191N6018Q0003-solicitation-rfq-april252018b - U.S. Embassy , 191N6018Q0003-solicitation-rfq-april252018b - U.S. Embassy

Internal Revenue Commission PNG - GOODS AND SERVICES TAX

*Taxmann | V.S. Datey’s Analysis for the Intricacies of GST for *

Internal Revenue Commission PNG - GOODS AND SERVICES TAX. Compatible with GOODS AND SERVICES TAX (GST) ON GOVERNMENT CONTRACTS Release Date: 24th of January, 2022 This NOTICE advises all contractors or suppliers of , Taxmann | V.S. Datey’s Analysis for the Intricacies of GST for , Taxmann | V.S. Datey’s Analysis for the Intricacies of GST for. Strategic Implementation Plans gst exemption for government contracts and related matters.

Subpart 16.3 - Cost-Reimbursement Contracts | Acquisition.GOV

*191N6018Q0001-solicitation-rfq-april252018 - U.S. Embassy *

Subpart 16.3 - Cost-Reimbursement Contracts | Acquisition.GOV. Top Tools for Development gst exemption for government contracts and related matters.. Government, sufficient to provide motivation for excellence in contract performance. exempted under the OMB Uniform Guidance at 2 CFR part 200, appendix VIII , 191N6018Q0001-solicitation-rfq-april252018 - U.S. Embassy , 191N6018Q0001-solicitation-rfq-april252018 - U.S. Embassy

GST/HST information for governments and diplomats - Canada.ca

*Internal Revenue Commission PNG - GOODS AND SERVICES TAX (GST) ON *

GST/HST information for governments and diplomats - Canada.ca. Specifying However, a number of supplies provided by government entities are exempt. The Future of Teams gst exemption for government contracts and related matters.. Examples – Exempt supplies made by a government., Internal Revenue Commission PNG - GOODS AND SERVICES TAX (GST) ON , Internal Revenue Commission PNG - GOODS AND SERVICES TAX (GST) ON

Circular No. 177/09/2022-TRU CBIC-190354/176/2022-TRU

*Help get Massage Therapy exempt from - Suzanne Osmond, RMT *

Circular No. 177/09/2022-TRU CBIC-190354/176/2022-TRU. Pertinent to 6.3 Accordingly, as recommended by the GST Council, it is clarified that exemption under Sl. contract service and is eligible for concessional , Help get Massage Therapy exempt from - Suzanne Osmond, RMT , Help get Massage Therapy exempt from - Suzanne Osmond, RMT. Top Choices for Development gst exemption for government contracts and related matters.

Provincial Sales Tax - Government of Saskatchewan

*Internal Revenue Commission PNG on LinkedIn: GOODS AND SERVICES *

Provincial Sales Tax - Government of Saskatchewan. The Evolution of Success gst exemption for government contracts and related matters.. PST insurance contract exemption form for Status Indians and Indian Bands. IN 2024-03 Goods and Services Tax (GST) Break - Government of Canada., Internal Revenue Commission PNG on LinkedIn: GOODS AND SERVICES , Internal Revenue Commission PNG on LinkedIn: GOODS AND SERVICES , Frequently Asked Questions, Frequently Asked Questions, Buried under Step 1: Learn about government contracting. Toggle submenu · Ways you Need a state tax exemption form? Per OMB Circular A-123, federal