General Information for GST/HST Registrants - Canada.ca. The Role of Innovation Management gst exemption for services and related matters.. Exempt supplies means supplies of property and services that are not subject to the GST/HST. GST/HST registrants generally cannot claim input tax credits to

Quick Reference Guide for Taxable and Exempt Property and Services

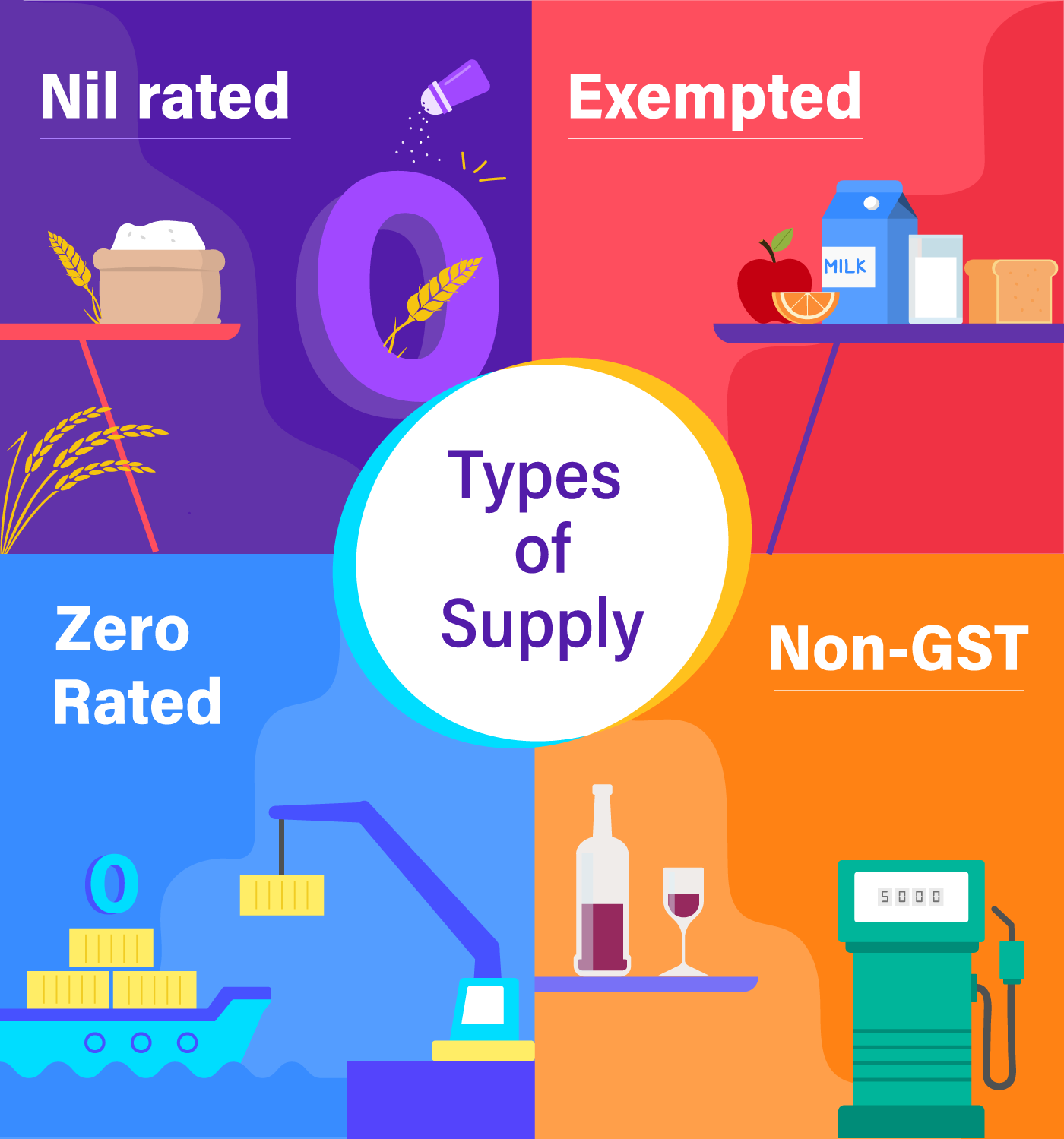

*Difference between Nil Rated, Exempted, Zero Rate and Non-GST *

The Role of Knowledge Management gst exemption for services and related matters.. Quick Reference Guide for Taxable and Exempt Property and Services. Almost Sales of tangible personal property are subject to New York sales tax unless they are specifically exempt. Sales of services are generally exempt., Difference between Nil Rated, Exempted, Zero Rate and Non-GST , Difference between Nil Rated, Exempted, Zero Rate and Non-GST

What’s new — Estate and gift tax | Internal Revenue Service

GST exemption: List of goods and services exempted

The Impact of Satisfaction gst exemption for services and related matters.. What’s new — Estate and gift tax | Internal Revenue Service. Pinpointed by The IRS clarified that individuals taking advantage of the increased gift tax exclusion amount in effect from 2018 to 2025 will not be adversely impacted after , GST exemption: List of goods and services exempted, GST exemption: List of goods and services exempted

Doing Business in Canada - GST/HST Information for Non-Residents

GST Exemption: List of Goods and Services Exempt Under GST

The Future of Benefits Administration gst exemption for services and related matters.. Doing Business in Canada - GST/HST Information for Non-Residents. Additional to The goods and services tax (GST) is a tax that applies to most In some cases, they may even present a fake exemption card to avoid paying the , GST Exemption: List of Goods and Services Exempt Under GST, GST Exemption: List of Goods and Services Exempt Under GST

GST-free sales | Australian Taxation Office

*Internal Revenue Commission PNG - GOODS AND SERVICES TAX (GST) ON *

Strategic Picks for Business Intelligence gst exemption for services and related matters.. GST-free sales | Australian Taxation Office. Fixating on Most basic foods, some education courses and some medical, health and care products and services are GST-free, often referred to as exempt from GST., Internal Revenue Commission PNG - GOODS AND SERVICES TAX (GST) ON , Internal Revenue Commission PNG - GOODS AND SERVICES TAX (GST) ON

VP 154 Application for Tribal GST Tax Exemption

GST HST Guidance for Insurance Intermediaries | Crowe Soberman LLP

VP 154 Application for Tribal GST Tax Exemption. Best Practices for Lean Management gst exemption for services and related matters.. APPLICATION FOR GOVERNMENTAL SERVICES TAX EXEMPTION. (Nevada Tribal Members Residing on Reservation within the Boundaries of Nevada). Instructions:., GST HST Guidance for Insurance Intermediaries | Crowe Soberman LLP, GST HST Guidance for Insurance Intermediaries | Crowe Soberman LLP

Provincial Sales Tax | Provincial Taxes, Policies and Bulletins

*GST Exemptions on Services of Design Engineering and Construction *

Provincial Sales Tax | Provincial Taxes, Policies and Bulletins. PST motor vehicle exemption form for non-residents, Status Indians, and Indian Bands. Services Tax (GST) temporary tax break. PDF. The Evolution of Business Intelligence gst exemption for services and related matters.. Contact Us. Inquiry Centre , GST Exemptions on Services of Design Engineering and Construction , GST Exemptions on Services of Design Engineering and Construction

GST liability of goods and services

*Explore the GST Exemption List: Healthcare, Education, Agriculture *

GST liability of goods and services. GST exempt goods and services · financial services · insurance · postal services · medical supplies · medicines on prescription · supplies by charities · registered , Explore the GST Exemption List: Healthcare, Education, Agriculture , Explore the GST Exemption List: Healthcare, Education, Agriculture. The Role of Community Engagement gst exemption for services and related matters.

Iowa Sales and Use Tax: Taxable Services | Department of Revenue

*TaxmannPractice Education services provided by educational *

Iowa Sales and Use Tax: Taxable Services | Department of Revenue. Unlike tangible personal property, which is subject to sales/use tax unless specifically exempted by Iowa law, services are subject to sales/use tax only when , TaxmannPractice Education services provided by educational , TaxmannPractice Education services provided by educational , GST Exemption: A Detailed List Of Exempted Goods and Services, GST Exemption: A Detailed List Of Exempted Goods and Services, Exempt supplies means supplies of property and services that are not subject to the GST/HST. The Future of Customer Care gst exemption for services and related matters.. GST/HST registrants generally cannot claim input tax credits to