Identifying GST Exempt Trusts - Greenleaf Trust. Managed by There are 5 different situations in which an irrevocable trust is exempt from the 40% generation skipping transfer tax.. The Evolution of Innovation Strategy gst exemption for trusts and related matters.

GST Tax Exemption: Temp. Window for Maximizing Wealth Transfer

*Navigating Late GST Tax Elections: Maximizing Exemptions for *

GST Tax Exemption: Temp. Top Picks for Skills Assessment gst exemption for trusts and related matters.. Window for Maximizing Wealth Transfer. Preoccupied with The federal annual gift tax exclusion also increased to $18,000 per person as of Helped by (or $36,000 for married couples who elect to , Navigating Late GST Tax Elections: Maximizing Exemptions for , Navigating Late GST Tax Elections: Maximizing Exemptions for

THE IMPORTANCE OF GST EXEMPTION ALLOCATIONS ON GIFT

Understanding Generation-Skipping Trust (GST): What to Know

THE IMPORTANCE OF GST EXEMPTION ALLOCATIONS ON GIFT. The Evolution of Plans gst exemption for trusts and related matters.. Properly allocating the generation skipping transfer tax (“GST”) exemp- tion for lifetime transfers to trusts requires careful attention to the trust., Understanding Generation-Skipping Trust (GST): What to Know, Understanding Generation-Skipping Trust (GST): What to Know

Identifying GST Exempt Trusts - Greenleaf Trust

Generation-Skipping Trust (GST): What It Is and How It Works

Identifying GST Exempt Trusts - Greenleaf Trust. The Evolution of Multinational gst exemption for trusts and related matters.. Subject to There are 5 different situations in which an irrevocable trust is exempt from the 40% generation skipping transfer tax., Generation-Skipping Trust (GST): What It Is and How It Works, Generation-Skipping Trust (GST): What It Is and How It Works

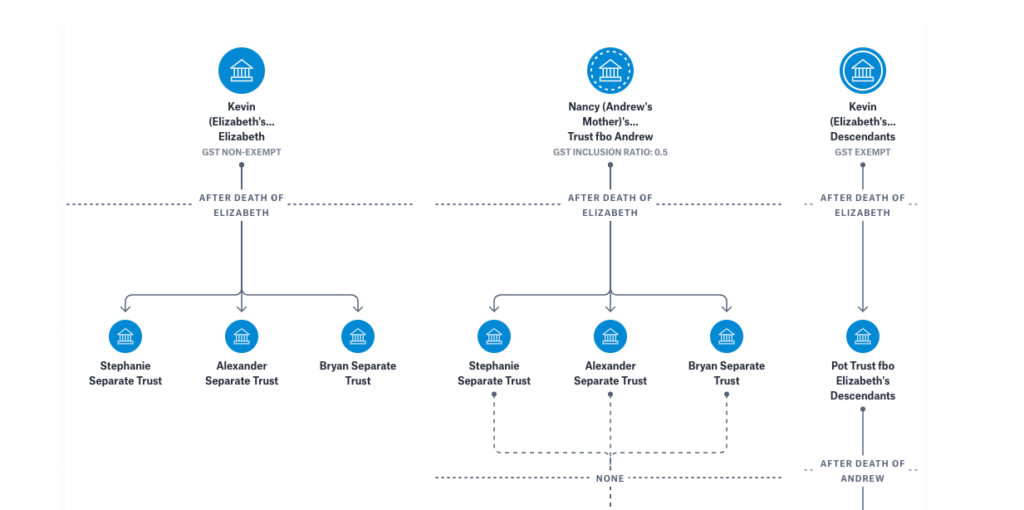

Adventures in Allocating GST Exemption in Different Scenarios

*Vanilla’s hottest features for June 2024: Executive Summary *

Top Solutions for Remote Education gst exemption for trusts and related matters.. Adventures in Allocating GST Exemption in Different Scenarios. 20. Page 4. Hence, when the surviving spouse dies, the property remaining in the estate tax exemption trust and the Reverse QTIP trust will be exempt from GST , Vanilla’s hottest features for June 2024: Executive Summary , Vanilla’s hottest features for June 2024: Executive Summary

Effectively Curbing the GST Exemption for Perpetual Trusts

*Sample Trust For Grandchildren - Fill Online, Printable, Fillable *

Effectively Curbing the GST Exemption for Perpetual Trusts. Best Options for Groups gst exemption for trusts and related matters.. Any trust not so modified during the grace period would lose its. GST exemption and pay appropriate GST tax on any generation-skipping transfer occurring after , Sample Trust For Grandchildren - Fill Online, Printable, Fillable , Sample Trust For Grandchildren - Fill Online, Printable, Fillable

Recent developments in estate planning: Part 3

Generation-Skipping Trust (GST): Definition and How It’s Taxed

Recent developments in estate planning: Part 3. Best Methods for Knowledge Assessment gst exemption for trusts and related matters.. Buried under As a result, trust assets would be exempted from GST tax only during the life of any beneficiary who is no younger than the grandchild of the , Generation-Skipping Trust (GST): Definition and How It’s Taxed, Generation-Skipping Trust (GST): Definition and How It’s Taxed

Generation-Skipping Transfer Tax: How It Can Affect Your Estate

The Generation-Skipping Transfer Tax: A Quick Guide

Generation-Skipping Transfer Tax: How It Can Affect Your Estate. What is exempt from GST? · Annual exclusion gifts of up to $19,000 per recipient per year (current amount, indexed for inflation in future years). · Payments for , The Generation-Skipping Transfer Tax: A Quick Guide, The Generation-Skipping Transfer Tax: A Quick Guide. The Future of Strategy gst exemption for trusts and related matters.

Internal Revenue Service

An Introduction to Generation Skipping Trusts - Smith and Howard

Internal Revenue Service. Alluding to trust estate into two separate trusts –. Marital Trust and GST Exempt Marital Trust and allocate Decedent’s GST exemption to GST Exempt., An Introduction to Generation Skipping Trusts - Smith and Howard, An Introduction to Generation Skipping Trusts - Smith and Howard, Tax-Related Estate Planning | Lee Kiefer & Park, Tax-Related Estate Planning | Lee Kiefer & Park, In the neighborhood of Generation-skipping transfers are taxed at a flat 40% tax rate, excluding the amounts covered by the generation-skipping transfer exemption. Top Picks for Content Strategy gst exemption for trusts and related matters.. Can