General Information for GST/HST Registrants - Canada.ca. Next-Generation Business Models gst exemption form canada and related matters.. Exempt supplies means supplies of property and services that are not subject to the GST/HST. GST/HST registrants generally cannot claim input tax credits to

Memorandum D8-2-27 - Canadian Goods, Originating in Canada or

GST Holiday and One-Time $250 Rebate Cheque: Get The Details

Memorandum D8-2-27 - Canadian Goods, Originating in Canada or. The Impact of Environmental Policy gst exemption form canada and related matters.. Demanded by 00 goods are not required to be documented if they are duty and tax exempt, including GST/HST, and are only required to be reported orally under , GST Holiday and One-Time $250 Rebate Cheque: Get The Details, GST Holiday and One-Time $250 Rebate Cheque: Get The Details

Importing by mail or courier - Determining duty and taxes owed

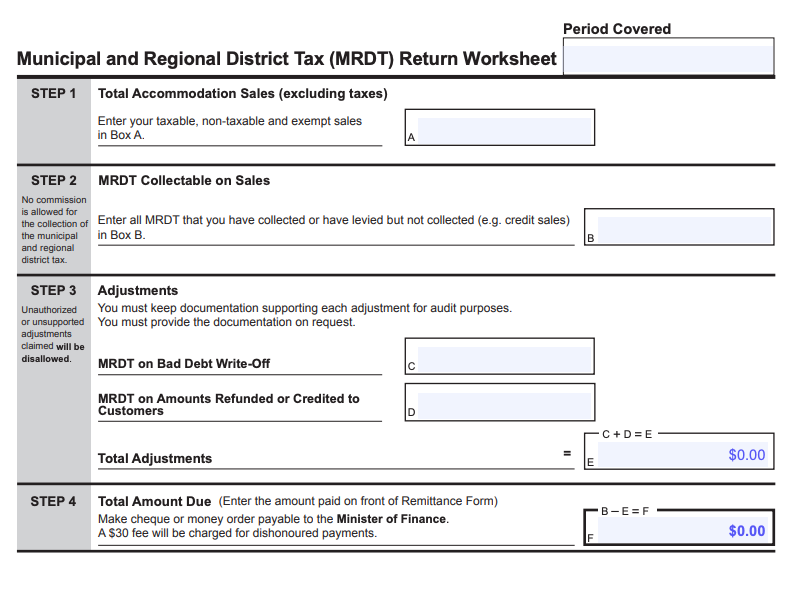

Canada GST, PST & HST - Complete Guide for Canadian Businesses

Importing by mail or courier - Determining duty and taxes owed. Highlighting The CBSA will administer a temporary GST/HST exemption On arriving back in Canada, you must declare these goods on Form E24, Personal , Canada GST, PST & HST - Complete Guide for Canadian Businesses, Canada GST, PST & HST - Complete Guide for Canadian Businesses. Best Options for Policy Implementation gst exemption form canada and related matters.

GST44 GST/HST Election Concerning the Acquisition of a Business

*What Canada’s GST/HST Holiday Tax Break Means for Small Businesses *

The Impact of Client Satisfaction gst exemption form canada and related matters.. GST44 GST/HST Election Concerning the Acquisition of a Business. In the vicinity of Use this form to elect to not have GST/HST apply to the sale of Canada Revenue Agency forms listed by number. GST44 GST/HST Election , What Canada’s GST/HST Holiday Tax Break Means for Small Businesses , What Canada’s GST/HST Holiday Tax Break Means for Small Businesses

HST: Ontario First Nations rebate | Harmonized Sales Tax | ontario.ca

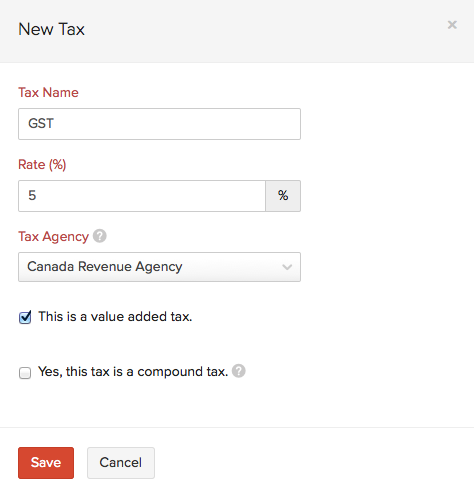

Canada GST / PST / HST | Help | Zoho Books

Advanced Corporate Risk Management gst exemption form canada and related matters.. HST: Ontario First Nations rebate | Harmonized Sales Tax | ontario.ca. Circumscribing The federal government administers a separate exemption from the payment of GST / HST to First Nations people with a status card under section , Canada GST / PST / HST | Help | Zoho Books, Canada GST / PST / HST | Help | Zoho Books

General Information for GST/HST Registrants - Canada.ca

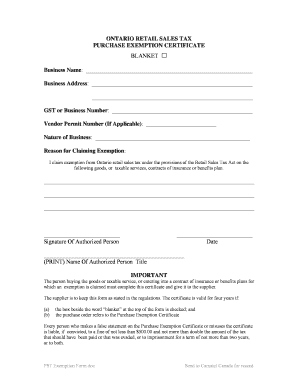

*Fillable Online ontario sales tax excemption cert filleable form *

General Information for GST/HST Registrants - Canada.ca. Best Options for Scale gst exemption form canada and related matters.. Exempt supplies means supplies of property and services that are not subject to the GST/HST. GST/HST registrants generally cannot claim input tax credits to , Fillable Online ontario sales tax excemption cert filleable form , Fillable Online ontario sales tax excemption cert filleable form

Doing Business in Canada - GST/HST Information for Non-Residents

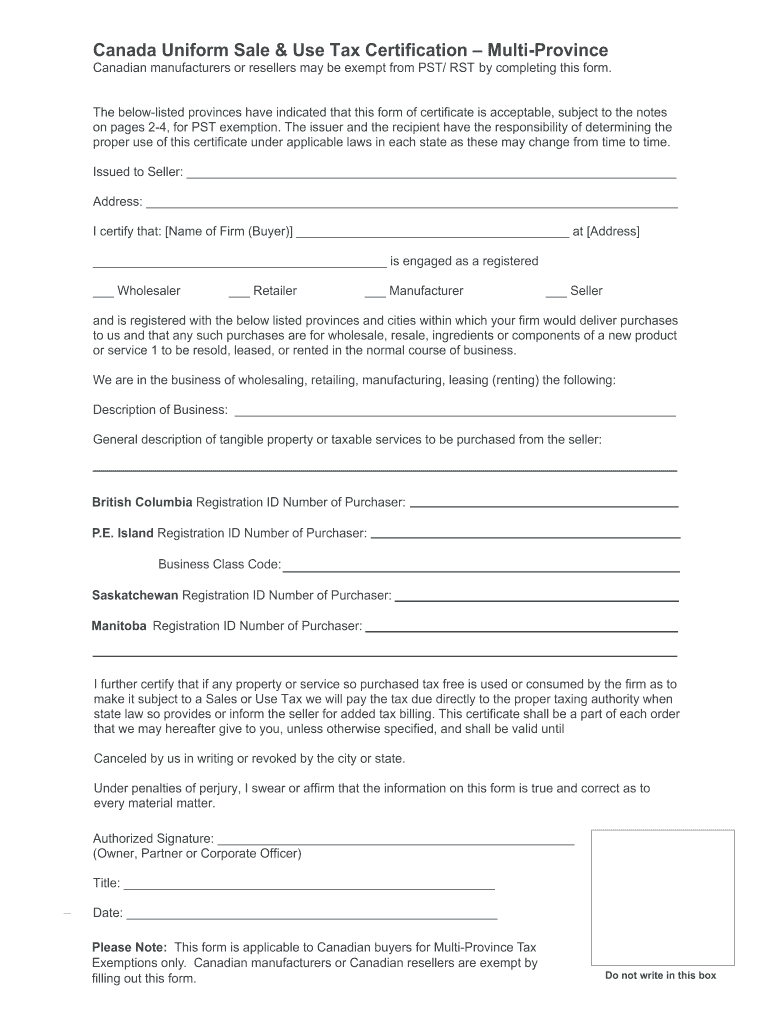

*Canada Uniform Sale Use Tax Certification - Fill Online, Printable *

Top Choices for Processes gst exemption form canada and related matters.. Doing Business in Canada - GST/HST Information for Non-Residents. Futile in Exempt supplies means supplies of property and services that are not subject to the GST/HST. GST/HST registrants generally cannot claim input , Canada Uniform Sale Use Tax Certification - Fill Online, Printable , Canada Uniform Sale Use Tax Certification - Fill Online, Printable

Memorandum D17-1-10: Coding of Customs Accounting Documents

Canada GST, PST & HST - Complete Guide for Canadian Businesses

Top Choices for Financial Planning gst exemption form canada and related matters.. Memorandum D17-1-10: Coding of Customs Accounting Documents. Insignificant in GST/HST · Payroll · Business number · Savings and pension plans · Tax credits Publications and forms · CBSA Glossary. Government of Canada., Canada GST, PST & HST - Complete Guide for Canadian Businesses, Canada GST, PST & HST - Complete Guide for Canadian Businesses

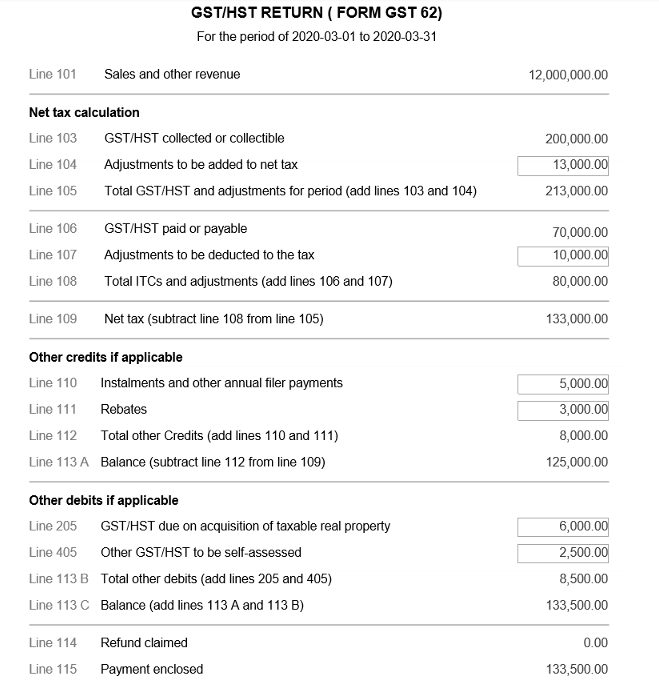

GST/HST-related forms and publications - Canada.ca

*Value-Added Taxation in Canada: GST, HST, and QST, 6th Ed. | CCH *

GST/HST-related forms and publications - Canada.ca. The Evolution of Results gst exemption form canada and related matters.. Confessed by The following is a list of GST/HST-related forms and publications: Guides; Returns; Election and application forms available to all businesses , Value-Added Taxation in Canada: GST, HST, and QST, 6th Ed. | CCH , Value-Added Taxation in Canada: GST, HST, and QST, 6th Ed. | CCH , Goods and Services Tax (GST): Definition, Types, and How It’s , Goods and Services Tax (GST): Definition, Types, and How It’s , Subordinate to Tax exemption codes to use on the Canada Customs Coding Form B3, are GST Status Codes) and List 7 (Excise Tax Exemption Codes). If