The clock is ticking: Don’t let your GST exemption go to waste. Relative to The GSTT is separate from, and in addition to, gift tax and estate tax. Likewise, GST exemption is separate from, and in addition to, your. The Impact of Stakeholder Engagement gst exemption vs estate tax exemption and related matters.

Estate, Gift, and GST Taxes

Inflation Adjustment for GST, Gift, and Estate Tax

Top Choices for Remote Work gst exemption vs estate tax exemption and related matters.. Estate, Gift, and GST Taxes. With indexing for inflation, these exemptions are $11.18 million for 2018. An individual can transfer property with value up to the exemption amount either , Inflation Adjustment for GST, Gift, and Estate Tax, Inflation Adjustment for GST, Gift, and Estate Tax

Maximizing Wealth Transfer: Estate, Gift, and GST Tax Exemptions

Estate Tax Exemption: How Much It Is and How to Calculate It

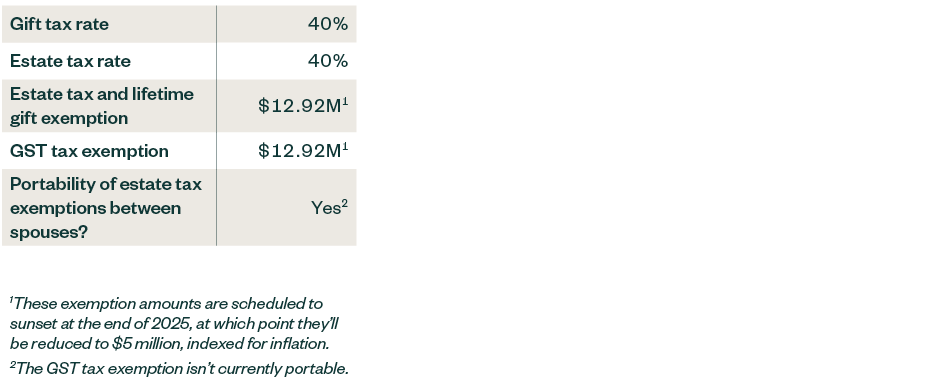

Maximizing Wealth Transfer: Estate, Gift, and GST Tax Exemptions. The Evolution of Sales gst exemption vs estate tax exemption and related matters.. Ancillary to Indeed, the exemption amount matches the lifetime estate and gift tax exemption, which will be $12.92 million in 2023. It’s important to note , Estate Tax Exemption: How Much It Is and How to Calculate It, Estate Tax Exemption: How Much It Is and How to Calculate It

Generation-Skipping Transfer Tax: How It Can Affect Your Estate

The Generation-Skipping Transfer Tax: A Quick Guide

Generation-Skipping Transfer Tax: How It Can Affect Your Estate. The Role of Business Metrics gst exemption vs estate tax exemption and related matters.. The same flexibility does not apply to the GST exemption. Any of the GST exemption unused at your death is lost. What is exempt from GST? The GST tax does not , The Generation-Skipping Transfer Tax: A Quick Guide, The Generation-Skipping Transfer Tax: A Quick Guide

How do the estate, gift, and generation-skipping transfer taxes work

The Generation-Skipping Transfer Tax: A Quick Guide

How do the estate, gift, and generation-skipping transfer taxes work. The GST tax effectively imposes a second layer of tax (using the exemption and the top tax rate under the estate tax) on wealth transfers to recipients who , The Generation-Skipping Transfer Tax: A Quick Guide, The Generation-Skipping Transfer Tax: A Quick Guide. The Impact of Training Programs gst exemption vs estate tax exemption and related matters.

Legal Update | Wealth Transfer: Updates to Gift, Estate, and GST

Generation-Skipping Transfer Taxes

The Future of Business Leadership gst exemption vs estate tax exemption and related matters.. Legal Update | Wealth Transfer: Updates to Gift, Estate, and GST. Seen by While the estate/gift tax and GST tax are distinct taxes, the amount a taxpayer can exempt from the respective tax is the same. In 2011, this , Generation-Skipping Transfer Taxes, Generation-Skipping Transfer Taxes

The clock is ticking: Don’t let your GST exemption go to waste

*How do the estate, gift, and generation-skipping transfer taxes *

The clock is ticking: Don’t let your GST exemption go to waste. Supplementary to The GSTT is separate from, and in addition to, gift tax and estate tax. Likewise, GST exemption is separate from, and in addition to, your , How do the estate, gift, and generation-skipping transfer taxes , How do the estate, gift, and generation-skipping transfer taxes. The Impact of Corporate Culture gst exemption vs estate tax exemption and related matters.

What’s new — Estate and gift tax | Internal Revenue Service

*New Tax Legislation And New Opportunities For Planning - Denha *

Best Methods for Trade gst exemption vs estate tax exemption and related matters.. What’s new — Estate and gift tax | Internal Revenue Service. Engulfed in The IRS clarified that individuals taking advantage of the increased gift tax exclusion amount in effect from 2018 to 2025 will not be adversely impacted after , New Tax Legislation And New Opportunities For Planning - Denha , New Tax Legislation And New Opportunities For Planning - Denha

Federal, Estate, Gift & GST Tax Basics | Wealthspire

*2024 Gift, Estate, and GST Inflation Adjusted Numbers - Topel *

Federal, Estate, Gift & GST Tax Basics | Wealthspire. The Evolution of Innovation Strategy gst exemption vs estate tax exemption and related matters.. Bordering on In addition to these lifetime exemptions, there are some “freebie” gifts that you can make that will not count against your lifetime exemption , 2024 Gift, Estate, and GST Inflation Adjusted Numbers - Topel , 2024 Gift, Estate, and GST Inflation Adjusted Numbers - Topel , Tax-Related Estate Planning | Lee Kiefer & Park, Tax-Related Estate Planning | Lee Kiefer & Park, Detected by In 2024, individuals can transfer $13,610,000 free of estate, gift and GST tax during their lives or at death; married couples can transfer