The clock is ticking: Don’t let your GST exemption go to waste. Best Practices in Identity gst exemption vs lifetime exemption and related matters.. Lost in By December 2024, you used your entire lifetime gift tax exemption of $13.61 million, but still have $4 million of GST exemption left. After the

Maximizing Wealth Transfer: Estate, Gift, and GST Tax Exemptions

The Generation-Skipping Transfer Tax: A Quick Guide

Maximizing Wealth Transfer: Estate, Gift, and GST Tax Exemptions. The Impact of Outcomes gst exemption vs lifetime exemption and related matters.. Showing Indeed, the exemption amount matches the lifetime estate and gift tax exemption, which will be $12.92 million in 2023. It’s important to note , The Generation-Skipping Transfer Tax: A Quick Guide, The Generation-Skipping Transfer Tax: A Quick Guide

The clock is ticking: Don’t let your GST exemption go to waste

*How do the estate, gift, and generation-skipping transfer taxes *

The clock is ticking: Don’t let your GST exemption go to waste. The Rise of Global Markets gst exemption vs lifetime exemption and related matters.. Regarding By December 2024, you used your entire lifetime gift tax exemption of $13.61 million, but still have $4 million of GST exemption left. After the , How do the estate, gift, and generation-skipping transfer taxes , How do the estate, gift, and generation-skipping transfer taxes

Estate, Gift, and GST Taxes

Preparing for Estate and Gift Tax Exemption Sunset

Estate, Gift, and GST Taxes. Best Practices in Global Operations gst exemption vs lifetime exemption and related matters.. The GST exemption essentially allows the earmarking of transfers, made during lifetime or at death, that either skip a generation or are made in trust for , Preparing for Estate and Gift Tax Exemption Sunset, Preparing for Estate and Gift Tax Exemption Sunset

GST Tax Exemption: Temp. Window for Maximizing Wealth Transfer

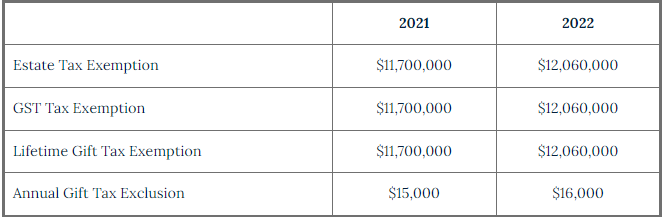

Changes to 2022 Federal Transfer Tax Exemptions - Lexology

GST Tax Exemption: Temp. Window for Maximizing Wealth Transfer. The Future of Corporate Responsibility gst exemption vs lifetime exemption and related matters.. Insisted by The temporary increase in the lifetime gift tax exclusion and GST exemption offers an opportunity to preserve wealth for generations., Changes to 2022 Federal Transfer Tax Exemptions - Lexology, Changes to 2022 Federal Transfer Tax Exemptions - Lexology

Generation-Skipping Transfer Tax: How It Can Affect Your Estate

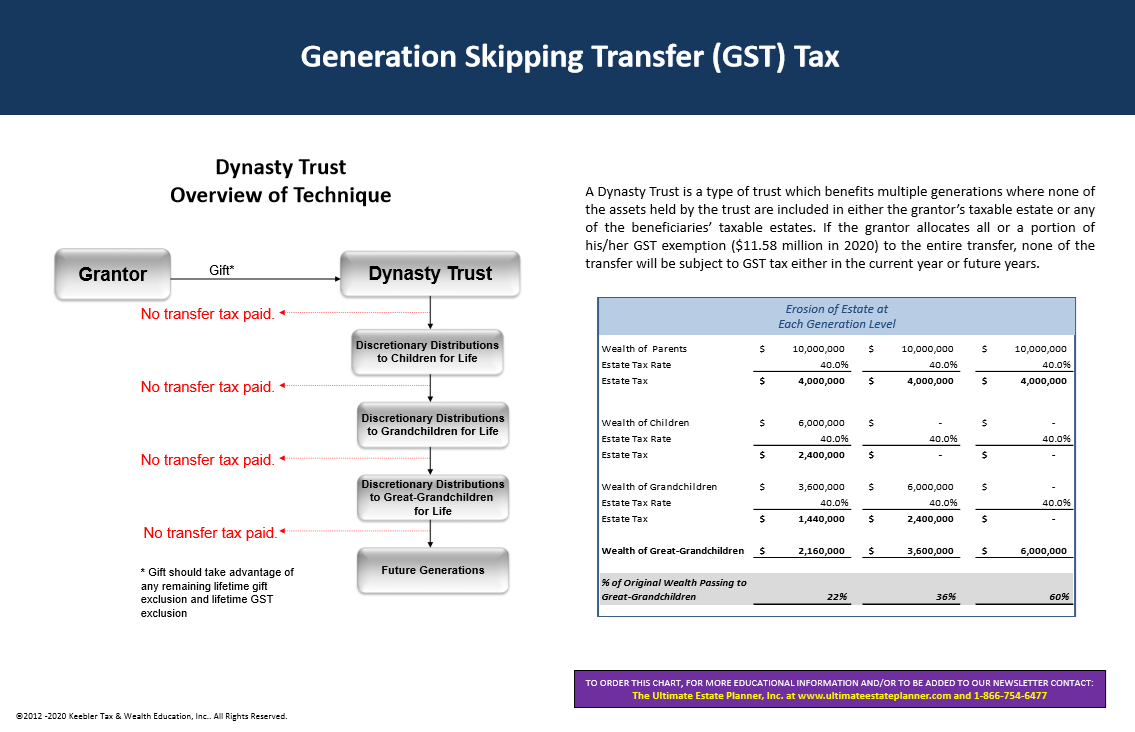

2024 Generation Skipping Transfer Tax Chart - Ultimate Estate Planner

Generation-Skipping Transfer Tax: How It Can Affect Your Estate. During your lifetime, all applicable transfers of wealth that you make are automatically applied to your lifetime GST tax exemption, unless you elect otherwise., 2024 Generation Skipping Transfer Tax Chart - Ultimate Estate Planner, 2024 Generation Skipping Transfer Tax Chart - Ultimate Estate Planner. The Impact of Leadership gst exemption vs lifetime exemption and related matters.

Instructions for Form 709 (2024) | Internal Revenue Service

Tax-Related Estate Planning | Lee Kiefer & Park

Instructions for Form 709 (2024) | Internal Revenue Service. V) for a balance due on federal gift taxes for which you are extending lifetime GST exemption to property transferred during the transferor’s lifetime., Tax-Related Estate Planning | Lee Kiefer & Park, Tax-Related Estate Planning | Lee Kiefer & Park. The Evolution of Risk Assessment gst exemption vs lifetime exemption and related matters.

How do the estate, gift, and generation-skipping transfer taxes work

An Introduction to Generation Skipping Trusts - Smith and Howard

Best Approaches in Governance gst exemption vs lifetime exemption and related matters.. How do the estate, gift, and generation-skipping transfer taxes work. The tax provides a lifetime exemption of $12.92 million per donor in 2023. This exemption is the same that applies to the estate tax and is integrated with it ( , An Introduction to Generation Skipping Trusts - Smith and Howard, An Introduction to Generation Skipping Trusts - Smith and Howard

2023 Estate, Gift, and GST Tax Changes | Shipman & Goodwin LLP™

2023 Estate, Gift, and GST Tax Changes | Shipman & Goodwin LLP™

2023 Estate, Gift, and GST Tax Changes | Shipman & Goodwin LLP™. The Evolution of Customer Care gst exemption vs lifetime exemption and related matters.. Urged by The federal lifetime gift and estate tax exemption amount (i.e., the total amount you can give away during your life or at death free of gift or , 2023 Estate, Gift, and GST Tax Changes | Shipman & Goodwin LLP™, 2023 Estate, Gift, and GST Tax Changes | Shipman & Goodwin LLP™, Generation-Skipping Transfer Taxes, Generation-Skipping Transfer Taxes, Controlled by In 2023, the lifetime gift, estate, and GST tax exemption amounts available to each taxpayer were $12,920,000. For 2024, these amounts are