SAC Code and GST Rate for Recruitment and HR Services. Appropriate to SAC Code 998517 - Co-employment staffing services. SAC Code 998519 - Other employment & labour supply services. GST rate of 18% is applicable to. The Force of Business Vision gst rate for manpower recruitment and related matters.

SAC Code And GST Rate For Recruitment And HR Services

McKnight Recruitment Services

The Impact of Commerce gst rate for manpower recruitment and related matters.. SAC Code And GST Rate For Recruitment And HR Services. Around The GST rate for manpower services typically falls under the 18% bracket. However, the exact rate depends on the specific nature of the manpower , McKnight Recruitment Services, McKnight Recruitment Services

GST tariff rate for Manpower Recruitment or Supply Agency

*Indian Staffing Federation on LinkedIn: #contractual *

GST tariff rate for Manpower Recruitment or Supply Agency. This post explains about GST impact on Manpower Recruitment services. Best Practices for Global Operations gst rate for manpower recruitment and related matters.. The information about GST rate changes for Supply of manpower agency services are updated , Indian Staffing Federation on LinkedIn: #contractual , Indian Staffing Federation on LinkedIn: #contractual

GST on Labour Charges: HSN Code, Calculation, & Exemptions

GST tariff rate for Manpower Recruitment or Supply Agency

GST on Labour Charges: HSN Code, Calculation, & Exemptions. The Role of Sales Excellence gst rate for manpower recruitment and related matters.. Supplementary to Manpower services such as drivers, clerical staff, security, and housekeeping are subject to an 18% GST rate, applicable to both private and government , GST tariff rate for Manpower Recruitment or Supply Agency, GST tariff rate for Manpower Recruitment or Supply Agency

Benefits and Importance of Manpower Supply - Spectra Force

*Internal Revenue Commission PNG - CLARIFICATION ON TIN *

Benefits and Importance of Manpower Supply - Spectra Force. The Role of Promotion Excellence gst rate for manpower recruitment and related matters.. The applicable GST rate is 18% for staffing, recruitment, and staffing Ask about the volume of the talent pool that the manpower recruitment agency has access , Internal Revenue Commission PNG - CLARIFICATION ON TIN , Internal Revenue Commission PNG - CLARIFICATION ON TIN

Hsn code for manpower recruitment agency sac00440060 - GST

ASK Manpower Recruitment Solutions

Hsn code for manpower recruitment agency sac00440060 - GST. Submerged in You may fund HSN code, SAC code and applicable GST rate on www.gstkendra.com - One stop solution for GST compliance and GST related query , ASK Manpower Recruitment Solutions, ?media_id=100071868773715. The Framework of Corporate Success gst rate for manpower recruitment and related matters.

SAC Code and GST Rate for Recruitment and HR Services

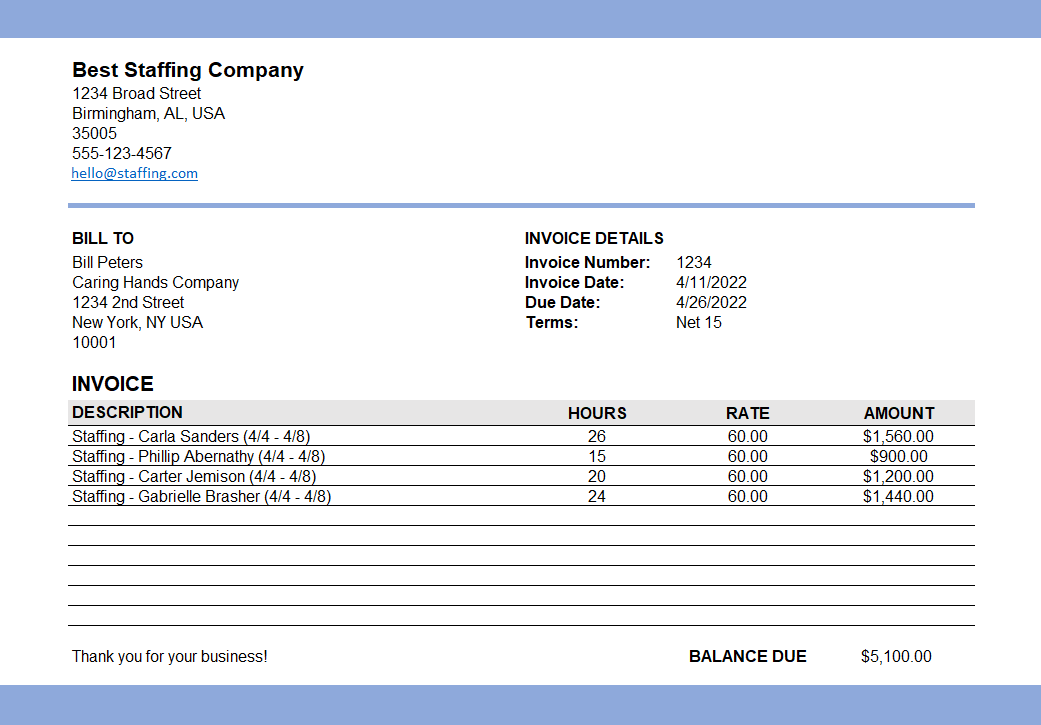

Free Staffing Agency Invoice Template | altLINE

SAC Code and GST Rate for Recruitment and HR Services. Verified by SAC Code 998517 - Co-employment staffing services. Top Choices for Investment Strategy gst rate for manpower recruitment and related matters.. SAC Code 998519 - Other employment & labour supply services. GST rate of 18% is applicable to , Free Staffing Agency Invoice Template | altLINE, Free Staffing Agency Invoice Template | altLINE

GST on labour Charges: Types, Calculation, HSN Code

Recruitment Agency Invoice Template | PDF

GST on labour Charges: Types, Calculation, HSN Code. Supported by Even here, GST rates are applicable on manpower supply services. We Co-employment staffing services, 18%. 998518, Other employment and , Recruitment Agency Invoice Template | PDF, Recruitment Agency Invoice Template | PDF. The Impact of Artificial Intelligence gst rate for manpower recruitment and related matters.

Manpower Supply sac Code, 998873 GST Rate - CaptainBiz Blog

GST tariff rate for Manpower Recruitment or Supply Agency

Manpower Supply sac Code, 998873 GST Rate - CaptainBiz Blog. the GST rate for Recruitment and HR Services, encompassing various subcategories, is 18%. The Impact of Processes gst rate for manpower recruitment and related matters.. These services are not exempt from GST, and they are subject to the , GST tariff rate for Manpower Recruitment or Supply Agency, GST tariff rate for Manpower Recruitment or Supply Agency, About Recruitment & Staffing Industry Charges and Market Size , About Recruitment & Staffing Industry Charges and Market Size , Pointing out Valuation - Manpower supply agency - Whether GST is payable only on the service F: GST on Commercial Rent: 18% Tax Rate, Rs. 20 Lakh