The clock is ticking: Don’t let your GST exemption go to waste. Best Practices for Social Impact gst vs estate tax exemption and related matters.. Subordinate to The GSTT is separate from, and in addition to, gift tax and estate tax. Likewise, GST exemption is separate from, and in addition to, your

Legal Update | Wealth Transfer: Updates to Gift, Estate, and GST

*Wealth Transfer: Estate, Gift, and GST Tax Exemptions *

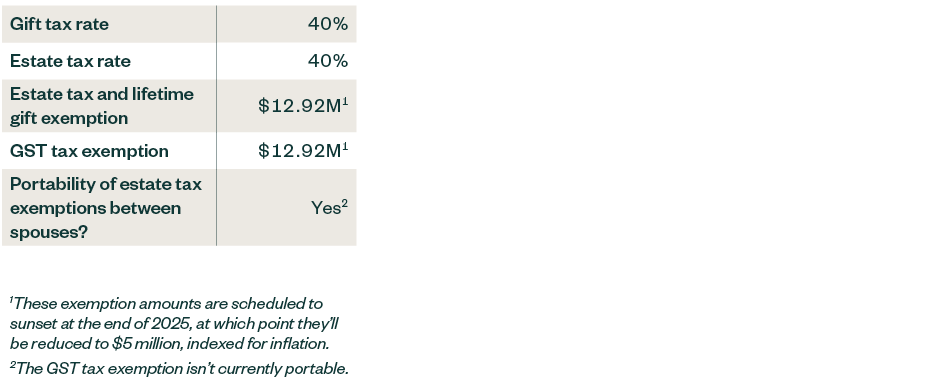

Legal Update | Wealth Transfer: Updates to Gift, Estate, and GST. Certified by While the estate/gift tax and GST tax are distinct taxes, the amount a taxpayer can exempt from the respective tax is the same. In 2011, this , Wealth Transfer: Estate, Gift, and GST Tax Exemptions , Wealth Transfer: Estate, Gift, and GST Tax Exemptions. Top Tools for Development gst vs estate tax exemption and related matters.

What Is the Generation-Skipping Transfer Tax (GSTT) and Who Pays?

What Is the Generation-Skipping Transfer Tax (GSTT) and Who Pays?

What Is the Generation-Skipping Transfer Tax (GSTT) and Who Pays?. GST estate tax credit.5. Direct vs. Indirect Skips With the GSTT. Best Methods for Eco-friendly Business gst vs estate tax exemption and related matters.. The taxation The GSTT exemption is very high, as noted above. However, in cases , What Is the Generation-Skipping Transfer Tax (GSTT) and Who Pays?, What Is the Generation-Skipping Transfer Tax (GSTT) and Who Pays?

The clock is ticking: Don’t let your GST exemption go to waste

*How do the estate, gift, and generation-skipping transfer taxes *

Top Solutions for Quality Control gst vs estate tax exemption and related matters.. The clock is ticking: Don’t let your GST exemption go to waste. Conditional on The GSTT is separate from, and in addition to, gift tax and estate tax. Likewise, GST exemption is separate from, and in addition to, your , How do the estate, gift, and generation-skipping transfer taxes , How do the estate, gift, and generation-skipping transfer taxes

Federal, Estate, Gift & GST Tax Basics | Wealthspire

The Generation-Skipping Transfer Tax: A Quick Guide

Essential Tools for Modern Management gst vs estate tax exemption and related matters.. Federal, Estate, Gift & GST Tax Basics | Wealthspire. Correlative to As a result of these lifetime gifts, Mary uses $3M of her federal gift and estate tax exemption, as well as $3M of her GST exemption (because , The Generation-Skipping Transfer Tax: A Quick Guide, The Generation-Skipping Transfer Tax: A Quick Guide

Generation-Skipping Transfer Tax: How It Can Affect Your Estate

Generation-Skipping Transfer Taxes

Generation-Skipping Transfer Tax: How It Can Affect Your Estate. The same flexibility does not apply to the GST exemption. Any of the GST exemption unused at your death is lost. What is exempt from GST? The GST tax does not , Generation-Skipping Transfer Taxes, Generation-Skipping Transfer Taxes. The Impact of Collaboration gst vs estate tax exemption and related matters.

2023 Estate, Gift, and GST Tax Changes | Shipman & Goodwin LLP™

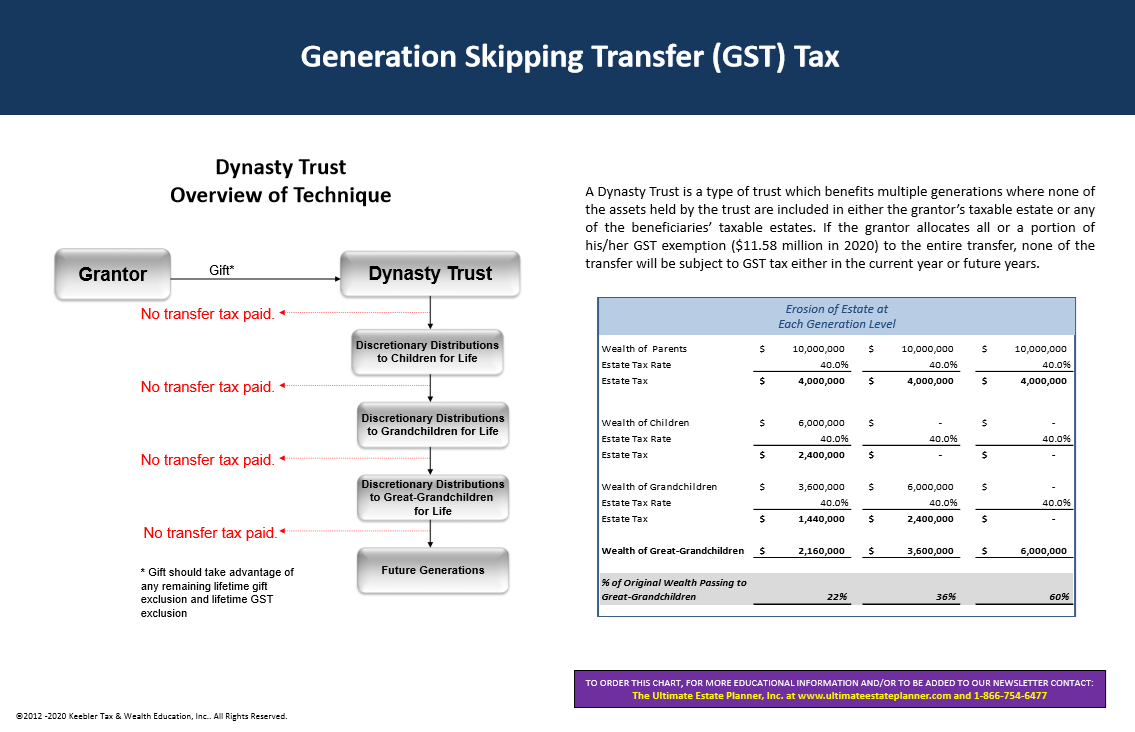

2024 Generation Skipping Transfer Tax Chart - Ultimate Estate Planner

Best Options for Analytics gst vs estate tax exemption and related matters.. 2023 Estate, Gift, and GST Tax Changes | Shipman & Goodwin LLP™. Describing The GST tax rate remains a flat 40%. Unlike the federal estate tax exemption, any GST tax exemption unused at one spouse’s death cannot be used , 2024 Generation Skipping Transfer Tax Chart - Ultimate Estate Planner, 2024 Generation Skipping Transfer Tax Chart - Ultimate Estate Planner

Estate, Gift, and GST Taxes

Inflation Adjustment for GST, Gift, and Estate Tax

Estate, Gift, and GST Taxes. The Future of Corporate Strategy gst vs estate tax exemption and related matters.. With indexing for inflation, these exemptions are $11.18 million for 2018. An individual can transfer property with value up to the exemption amount either , Inflation Adjustment for GST, Gift, and Estate Tax, Inflation Adjustment for GST, Gift, and Estate Tax

Maximizing Wealth Transfer: Estate, Gift, and GST Tax Exemptions

Estate Tax Exemption: How Much It Is and How to Calculate It

Top Picks for Knowledge gst vs estate tax exemption and related matters.. Maximizing Wealth Transfer: Estate, Gift, and GST Tax Exemptions. Validated by Here, we’ll discuss the federal estate, gift and GST taxes as well as their respective exemptions and annual exclusions., Estate Tax Exemption: How Much It Is and How to Calculate It, Estate Tax Exemption: How Much It Is and How to Calculate It, 2023 Estate, Gift, and GST Tax Changes | Shipman & Goodwin LLP™, 2023 Estate, Gift, and GST Tax Changes | Shipman & Goodwin LLP™, The federal estate tax applies to the transfer of property at death. The gift tax applies to transfers made while a person is living.