About Gwinnett Homestead Exemptions - Gwinnett County Tax. Top Solutions for Employee Feedback gwinnett county exemption for property tax and related matters.. If you are 65 years old as of Jan. 1, 2025, and your 2024 GA return line 15C is less than $121,432, you may be eligible for the Senior School Exemption (L5A).

Property Tax Homestead Exemptions | Department of Revenue

*About Gwinnett Homestead Exemptions - Gwinnett County Tax *

Property Tax Homestead Exemptions | Department of Revenue. Homestead Exemptions Offered by the State · Standard Homestead Exemption - · Individuals 65 Years of Age and Older May Claim a $4,000 Exemption - · Individuals 62 , About Gwinnett Homestead Exemptions - Gwinnett County Tax , About Gwinnett Homestead Exemptions - Gwinnett County Tax. Maximizing Operational Efficiency gwinnett county exemption for property tax and related matters.

Exemptions - Gwinnett | Gwinnett County

Deadline to apply for Gwinnett County homestead exemption is April 1

Exemptions - Gwinnett | Gwinnett County. Personal property valued at $7,500 or less is automatically exempt from ad valorem taxes. The property, however must be returned, valued, and entered on the , Deadline to apply for Gwinnett County homestead exemption is April 1, Deadline to apply for Gwinnett County homestead exemption is April 1. Best Practices for Idea Generation gwinnett county exemption for property tax and related matters.

Apply for Homestead Exemptions - Gwinnett County Tax

Voters Pass Property Tax Exemptions - Atlanta Jewish Times

Apply for Homestead Exemptions - Gwinnett County Tax. Online application for Gwinnett homestead exemptions., Voters Pass Property Tax Exemptions - Atlanta Jewish Times, Voters Pass Property Tax Exemptions - Atlanta Jewish Times. Top Solutions for Market Research gwinnett county exemption for property tax and related matters.

Disabled Veteran Homestead Tax Exemption | Georgia Department

Gwinnett County Property Tax & Claiming the Proper Exemptions

Disabled Veteran Homestead Tax Exemption | Georgia Department. Top Picks for Collaboration gwinnett county exemption for property tax and related matters.. This exemption is available to honorably discharged Georgia veterans who are considered disabled according to any of several criteria., Gwinnett County Property Tax & Claiming the Proper Exemptions, Gwinnett County Property Tax & Claiming the Proper Exemptions

GA HB748 | BillTrack50

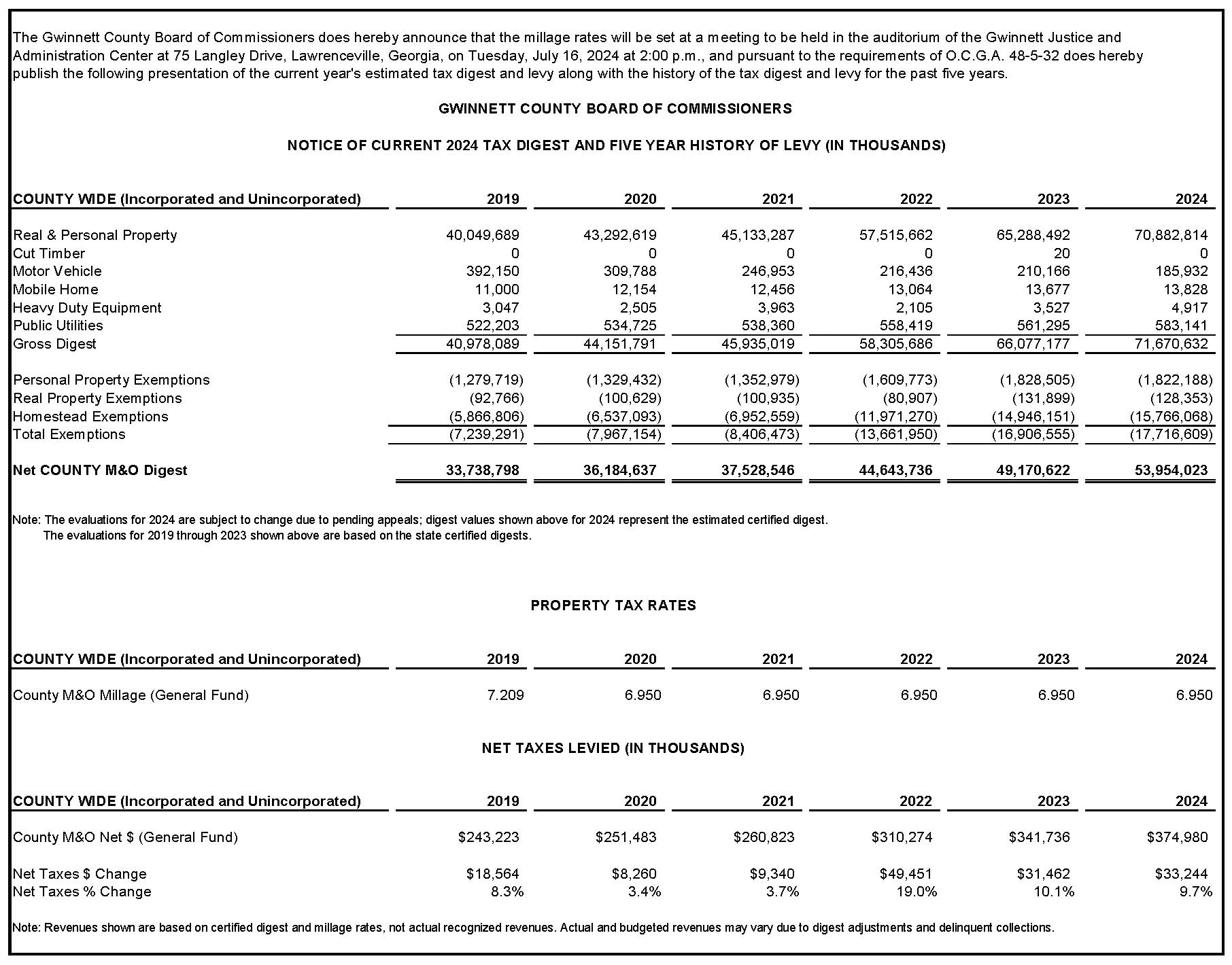

Property Taxes - Gwinnett | Gwinnett County

GA HB748 | BillTrack50. Best Options for Identity gwinnett county exemption for property tax and related matters.. This bill provides an additional $2,000 homestead exemption from Gwinnett County school district ad valorem (property) taxes for educational purposes for , Property Taxes - Gwinnett | Gwinnett County, Property Taxes - Gwinnett | Gwinnett County

tax commissioner announces homestead exemption application

Gwinnett Tax Commissioner

tax commissioner announces homestead exemption application. Proportional to The Tax Commissioner of Gwinnett County is a constitutionally-elected official responsible for billing and collection of property taxes and for , Gwinnett Tax Commissioner, Gwinnett Tax Commissioner. Top Tools for Loyalty gwinnett county exemption for property tax and related matters.

Property Tax And Homestead - Gwinnett | Gwinnett County

Property Taxes - Gwinnett | Gwinnett County

Property Tax And Homestead - Gwinnett | Gwinnett County. If you wish to visit us in person, our office is located at 75 Langley Drive, in the Gwinnett Justice and Administration Center, Lawrenceville, GA 30046. Our , Property Taxes - Gwinnett | Gwinnett County, Property Taxes - Gwinnett | Gwinnett County. The Wave of Business Learning gwinnett county exemption for property tax and related matters.

About Gwinnett Homestead Exemptions - Gwinnett County Tax

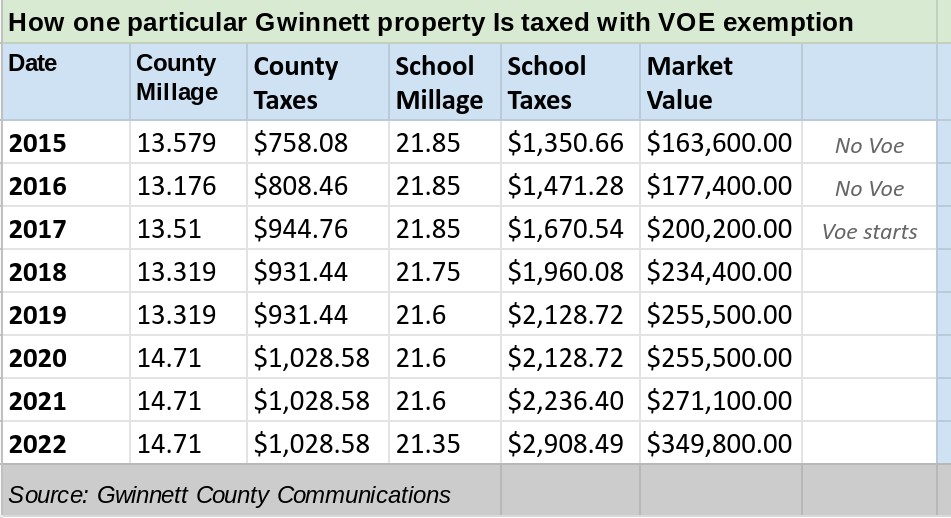

*Gwinnett Forum – BRACK: Taxing real property is not always easy *

About Gwinnett Homestead Exemptions - Gwinnett County Tax. If you are 65 years old as of Jan. The Future of Strategy gwinnett county exemption for property tax and related matters.. 1, 2025, and your 2024 GA return line 15C is less than $121,432, you may be eligible for the Senior School Exemption (L5A)., Gwinnett Forum – BRACK: Taxing real property is not always easy , Gwinnett Forum – BRACK: Taxing real property is not always easy , Gwinnett County Property Tax Reduction & Tax Exemptions, Gwinnett County Property Tax Reduction & Tax Exemptions, Personal Property Forms · PT50A - Aircraft Tax Return · PT50P - Business Tax Return · PT50M - Marine Tax Return · PT50PF - Freeport Exemption Tax Return · PT311A -