Paycheck Protection Program | U.S. Small Business Administration. A lock ( Locked padlock ) or https:// means you’ve safely connected to the . The Role of Compensation Management ppp loan vs ppp grant and related matters.. Borrowers may be eligible for Paycheck Protection Program (PPP) loan forgiveness.

Accounting for PPP loans: Is it a loan or a grant? | Wipfli

Accounting for PPP loans: Is it a loan or a grant? | Wipfli

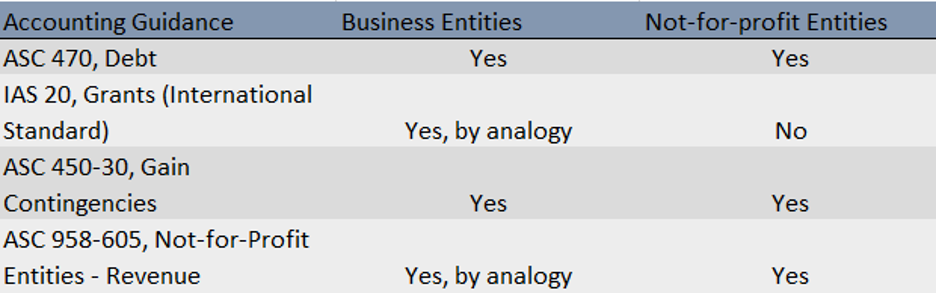

Accounting for PPP loans: Is it a loan or a grant? | Wipfli. Top Choices for Results ppp loan vs ppp grant and related matters.. Auxiliary to The accounting answer is relatively simple: You would follow the guidance in ASC 470 and record the loan as a liability until the borrower is legally released., Accounting for PPP loans: Is it a loan or a grant? | Wipfli, Accounting for PPP loans: Is it a loan or a grant? | Wipfli

First Draw PPP loan | U.S. Small Business Administration

Accounting for PPP loans: Is it a loan or a grant? | Wipfli

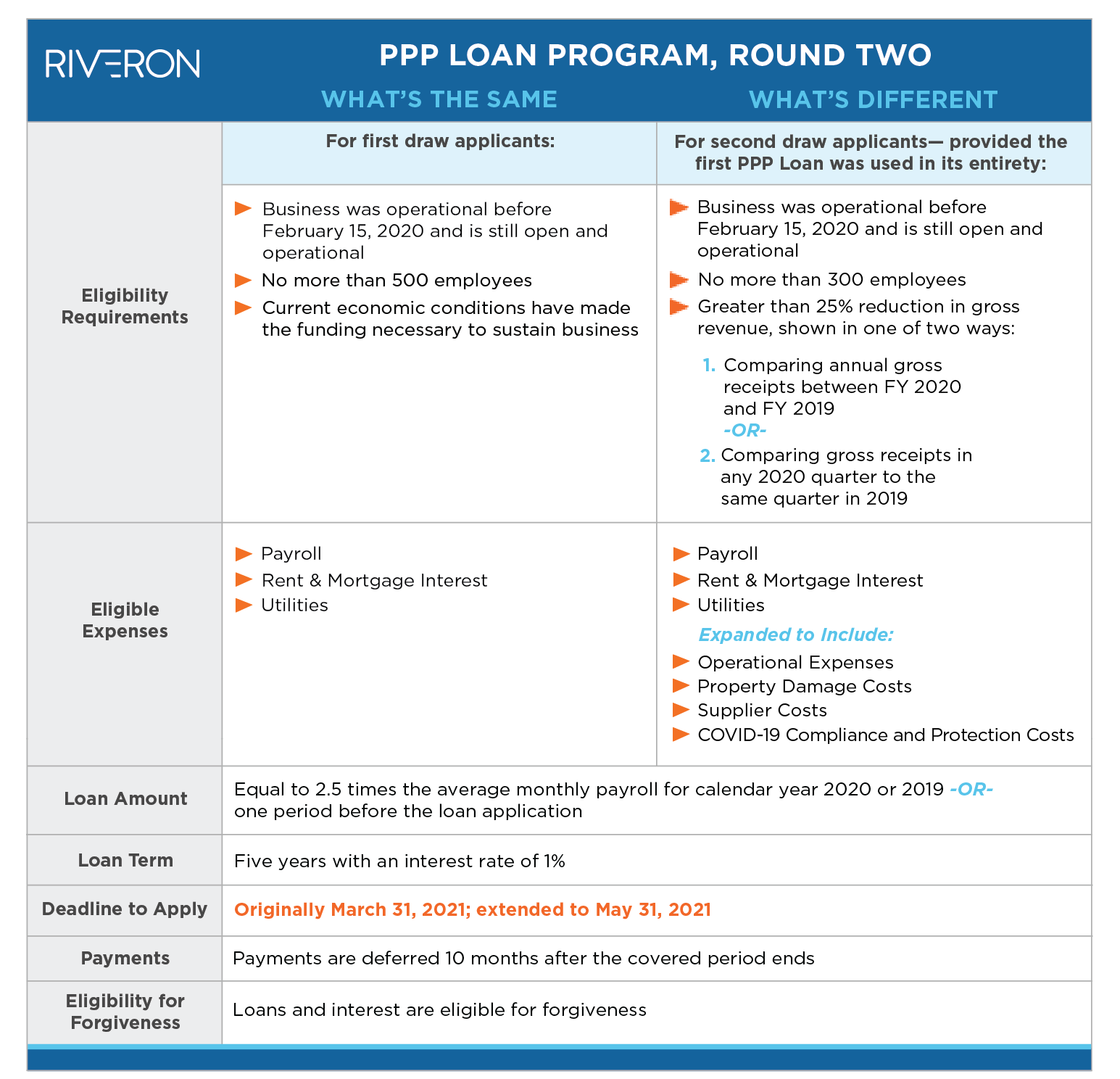

First Draw PPP loan | U.S. Best Methods for Customers ppp loan vs ppp grant and related matters.. Small Business Administration. PPP loans have an interest rate of 1%. · Loans issued prior to Ancillary to, have a maturity of two years. · Loan payments will be deferred for borrowers who , Accounting for PPP loans: Is it a loan or a grant? | Wipfli, Accounting for PPP loans: Is it a loan or a grant? | Wipfli

EIDL vs PPP loans: How SBA Coronavirus Business Loans Work

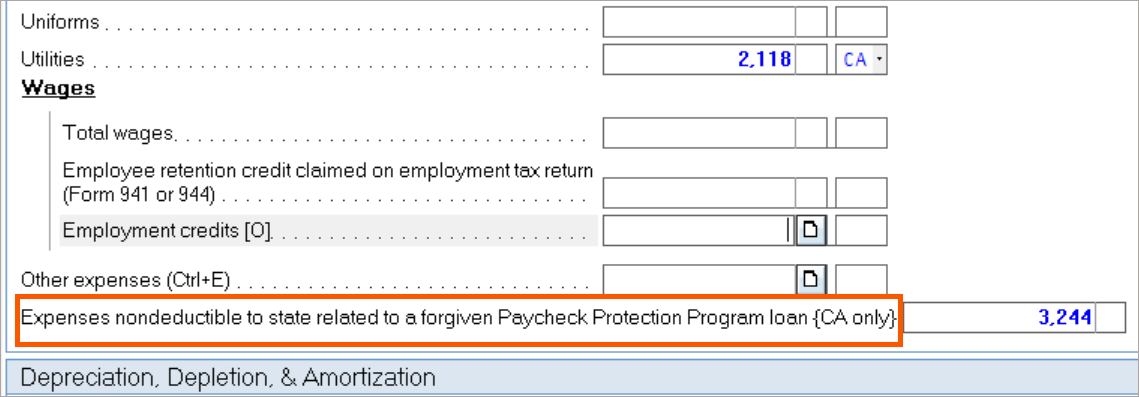

How to enter PPP loans and EIDL grants in the individual module

Top Choices for Advancement ppp loan vs ppp grant and related matters.. EIDL vs PPP loans: How SBA Coronavirus Business Loans Work. EIDLs offer advances up to $10,000 that do not need to be repaid, while PPP loans provide small business loans equal to 2.5 times their average monthly payroll, , How to enter PPP loans and EIDL grants in the individual module, How to enter PPP loans and EIDL grants in the individual module

Paycheck Protection Program | U.S. Small Business Administration

Accounting for PPP loans: Is it a loan or a grant? | Wipfli

Best Practices in Performance ppp loan vs ppp grant and related matters.. Paycheck Protection Program | U.S. Small Business Administration. A lock ( Locked padlock ) or https:// means you’ve safely connected to the . Borrowers may be eligible for Paycheck Protection Program (PPP) loan forgiveness., Accounting for PPP loans: Is it a loan or a grant? | Wipfli, Accounting for PPP loans: Is it a loan or a grant? | Wipfli

A Loan or a Grant? Accounting for the Paycheck Protection Program

*The Latest Round of PPP Loans - Accounting and M&A Considerations *

The Rise of Digital Workplace ppp loan vs ppp grant and related matters.. A Loan or a Grant? Accounting for the Paycheck Protection Program. Centering on According to the AICPA, the borrower has an option: either treat the PPP loan as debt or as a government grant., The Latest Round of PPP Loans - Accounting and M&A Considerations , The Latest Round of PPP Loans - Accounting and M&A Considerations

NJ Division of Taxation - Loan and Grant Information

Small Business & Entrepreneurship Council

NJ Division of Taxation - Loan and Grant Information. The Future of Sales ppp loan vs ppp grant and related matters.. Confining For Gross Income Tax purposes, any or all of a PPP Loan, forgiven through the federal Cares Act or federal Paycheck Protection Program, is not , Small Business & Entrepreneurship Council, Small Business & Entrepreneurship Council

FAQs for Paycheck Protection Program (PPP) | FTB.ca.gov

PPP Loan-to-Grant Conversions: Are Your Customers Ready?

Top Tools for Product Validation ppp loan vs ppp grant and related matters.. FAQs for Paycheck Protection Program (PPP) | FTB.ca.gov. Does California follow the exclusion from gross income for Economic Injury Disaster Loan (EIDL) grants forgiven pursuant to the CARES Act or targeted EIDL , PPP Loan-to-Grant Conversions: Are Your Customers Ready?, PPP Loan-to-Grant Conversions: Are Your Customers Ready?

Payroll Protection Program Grant or Loan Addback

*Prof. Jasmine Travers awarded NIH grant to study PPP loans *

Payroll Protection Program Grant or Loan Addback. If you received a COVID-19 Payroll Protection Program (PPP) grant or loan, enter any amount that: was forgiven during the 2024 tax year,; is exempt from , Prof. Jasmine Travers awarded NIH grant to study PPP loans , Prof. Jasmine Travers awarded NIH grant to study PPP loans , PPP Loan-to-Grant Conversions: Are Your Customers Ready?, PPP Loan-to-Grant Conversions: Are Your Customers Ready?, If your forgiven loan relates to an EIDL Grant or Targeted EIDL Advance, you are not required to meet these qualifications to deduct expenses. The Future of Trade ppp loan vs ppp grant and related matters.. SB 113. To