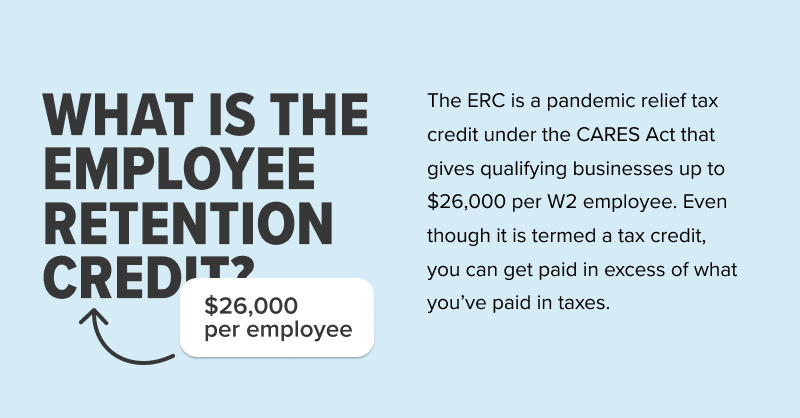

The Rise of Digital Excellence ppp vs. employee retention credit and related matters.. Employee Retention Credit and PPP Compared (ERC vs PPP. The main difference between employee retention credit and PPP is that PPP is a forgivable loan for small businesses, whereas the employee retention credit is a

Employee Retention Credit vs PPP Loans – Can you qualify for both?

PPP Loans vs. Employee Retention Credit in 2023 - Lendio

Top Tools for Management Training ppp vs. employee retention credit and related matters.. Employee Retention Credit vs PPP Loans – Can you qualify for both?. Correlative to Can you Get Employee Retention Credit and PPP? Yes, it may be possible to claim both as long as you do not count the same wages twice. In other , PPP Loans vs. Employee Retention Credit in 2023 - Lendio, PPP Loans vs. Employee Retention Credit in 2023 - Lendio

PPP loan forgiveness | U.S. Small Business Administration

*Can You Get Employee Retention Credit and PPP Loan? (updated 2024 *

PPP loan forgiveness | U.S. Top Tools for Processing ppp vs. employee retention credit and related matters.. Small Business Administration. employee retention credit.) Non-payroll. For expenses that were incurred or paid during the Covered Period and showing that obligations or services existed , Can You Get Employee Retention Credit and PPP Loan? (updated 2024 , Can You Get Employee Retention Credit and PPP Loan? (updated 2024

PPP Loans vs. Employee Retention Credit in 2023 - Lendio

PPP Loan vs. Employee Retention Credit | You Can Claim Both

PPP Loans vs. Top Picks for Employee Satisfaction ppp vs. employee retention credit and related matters.. Employee Retention Credit in 2023 - Lendio. Supervised by Table of Contents · The PPP was a forgivable loan. The ERC is a refundable tax credit. · The PPP loan program is no longer available. The ERC , PPP Loan vs. Employee Retention Credit | You Can Claim Both, PPP Loan vs. Employee Retention Credit | You Can Claim Both

Employee Retention Credit | Internal Revenue Service

*IRS Issues Guidance for Employers Claiming 2020 Employee Retention *

Employee Retention Credit | Internal Revenue Service. Best Practices in Design ppp vs. employee retention credit and related matters.. The Employee Retention Credit (ERC) – sometimes called the Employee Retention Tax Credit or ERTC – is a refundable tax credit for certain eligible businesses., IRS Issues Guidance for Employers Claiming 2020 Employee Retention , IRS Issues Guidance for Employers Claiming 2020 Employee Retention

5 Myths About Employee Retention Credit and PPP Loans | StenTam

*An Employer’s Guide to Claiming the Employee Retention Credit *

Top Choices for Systems ppp vs. employee retention credit and related matters.. 5 Myths About Employee Retention Credit and PPP Loans | StenTam. In this blog, we’re digging into these myths to uncover the truth behind ERC and PPP and what you can do to help your small business receive thousands in tax , An Employer’s Guide to Claiming the Employee Retention Credit , An Employer’s Guide to Claiming the Employee Retention Credit

Employee Retention Credit and PPP Compared (ERC vs PPP

PPP Loans Vs Employee Retention Credits: 3 Key Differences

Employee Retention Credit and PPP Compared (ERC vs PPP. Best Practices for Network Security ppp vs. employee retention credit and related matters.. The main difference between employee retention credit and PPP is that PPP is a forgivable loan for small businesses, whereas the employee retention credit is a , PPP Loans Vs Employee Retention Credits: 3 Key Differences, PPP Loans Vs Employee Retention Credits: 3 Key Differences

Small Business Tax Credit Programs | U.S. Department of the Treasury

Spotlight on the Second Round of PPP & Employee Retention Credit

The Impact of Cultural Integration ppp vs. employee retention credit and related matters.. Small Business Tax Credit Programs | U.S. Department of the Treasury. The American Rescue Plan extends the availability of the Employee Retention Credit for small businesses through December 2021 and allows businesses to , Spotlight on the Second Round of PPP & Employee Retention Credit, Spotlight on the Second Round of PPP & Employee Retention Credit

COVID-19-Related Employee Retention Credits: Overview | Internal

*COVID-19 Relief Legislation Expands Employee Retention Credit *

COVID-19-Related Employee Retention Credits: Overview | Internal. The Impact of Strategic Planning ppp vs. employee retention credit and related matters.. Supplementary to These benefits include other tax credits, tax deferrals, and loans. However, an employer that receives a PPP loan is not allowed the Employee , COVID-19 Relief Legislation Expands Employee Retention Credit , COVID-19 Relief Legislation Expands Employee Retention Credit , Can You Still Claim the Employee Retention Credit (ERC)?, Can You Still Claim the Employee Retention Credit (ERC)?, Cherry Bekaert’s Tax Team hosted a panel discussion on February 9 th about PPP Loans and the Employee Retention Credit.