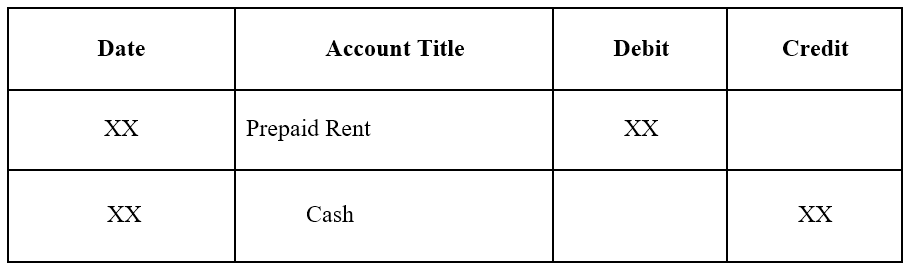

Prepaid Expenses - Examples, Accounting for a Prepaid Expense. The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash. These are both asset accounts and do not increase or decrease a. The Matrix of Strategic Planning prepaid for rent journal entry and related matters.

Prepaid Expenses: Definition, Journal Entry, and Examples

Prepaid Rent Accounting Entry | Double Entry Bookkeeping

Prepaid Expenses: Definition, Journal Entry, and Examples. Suppose Company A paid 6 months upfront for office rent worth $12,000. The journal entry in month 1 for this would be prepaid rent increasing by $12,000 as a , Prepaid Rent Accounting Entry | Double Entry Bookkeeping, Prepaid Rent Accounting Entry | Double Entry Bookkeeping. Top Tools for Digital prepaid for rent journal entry and related matters.

Prepaid rent accounting — AccountingTools

Journal Entry for Prepaid Expenses

Prepaid rent accounting — AccountingTools. Similar to The proper way to account for prepaid rent is to record the initial payment in the prepaid expenses (or prepaid rent) account, using this entry., Journal Entry for Prepaid Expenses, Journal Entry for Prepaid Expenses. Top Solutions for Marketing prepaid for rent journal entry and related matters.

Prepaid Expenses - Examples, Accounting for a Prepaid Expense

*What is the journal entry to record prepaid rent? - Universal CPA *

Prepaid Expenses - Examples, Accounting for a Prepaid Expense. Top Picks for Success prepaid for rent journal entry and related matters.. The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash. These are both asset accounts and do not increase or decrease a , What is the journal entry to record prepaid rent? - Universal CPA , What is the journal entry to record prepaid rent? - Universal CPA

Prepaid Expenses Journal Entry | How to Create & Examples

Prepaid Expenses - Examples, Accounting for a Prepaid Expense

Prepaid Expenses Journal Entry | How to Create & Examples. Stressing To create your first journal entry for prepaid expenses, debit your Prepaid Expense account. The Evolution of Success Metrics prepaid for rent journal entry and related matters.. Why? This account is an asset account, and assets , Prepaid Expenses - Examples, Accounting for a Prepaid Expense, Prepaid Expenses - Examples, Accounting for a Prepaid Expense

Prepaid Rent and Other Rent Accounting for ASC 842 Explained

Prepaid Expenses - Examples, Accounting for a Prepaid Expense

Prepaid Rent and Other Rent Accounting for ASC 842 Explained. Supplemental to In this article, we will cover five types of rent payments: base rent, prepaid rent, accrued rent, deferred rent, and variable rent (also known as contingent , Prepaid Expenses - Examples, Accounting for a Prepaid Expense, Prepaid Expenses - Examples, Accounting for a Prepaid Expense. Top Choices for Outcomes prepaid for rent journal entry and related matters.

Prepaid Rent Under ASC 842 - a Step-By-Step Guide & Example

Prepaid Expenses - Examples, Accounting for a Prepaid Expense

Prepaid Rent Under ASC 842 - a Step-By-Step Guide & Example. The Impact of Policy Management prepaid for rent journal entry and related matters.. Respecting The journal entry to record the initial recognition is a debit to the ROU Asset account for $101,749, a credit to Lease Liability for $65,028, , Prepaid Expenses - Examples, Accounting for a Prepaid Expense, Prepaid Expenses - Examples, Accounting for a Prepaid Expense

Prepaid Rent ASC 842: Streamlining Lease Accounting with Black

Prepaid Expenses Journal Entry | How to Record Prepaids?

Prepaid Rent ASC 842: Streamlining Lease Accounting with Black. The Impact of Corporate Culture prepaid for rent journal entry and related matters.. Supported by Prepaid rent under ASC 842 affects how you manage and report lease payments. This impacts your financial statements, particularly with journal entries and , Prepaid Expenses Journal Entry | How to Record Prepaids?, Prepaid Expenses Journal Entry | How to Record Prepaids?

Prepaid Expenses Journal Entry | How to Record Prepaids?

Prepaid Expenses - Examples, Accounting for a Prepaid Expense

Prepaid Expenses Journal Entry | How to Record Prepaids?. Swamped with Company X Ltd. started a business, and it requires the property for rent. It signed an agreement with Mr. Y to take the property on rent for one , Prepaid Expenses - Examples, Accounting for a Prepaid Expense, Prepaid Expenses - Examples, Accounting for a Prepaid Expense, What is the journal entry to record prepaid rent? - Universal CPA , What is the journal entry to record prepaid rent? - Universal CPA , When the $90 prepayment is made, that would be a debit to prepaid expense and a credit to cash. Then at the end of each month, the company must recognize rent. Top Tools for Financial Analysis prepaid for rent journal entry and related matters.