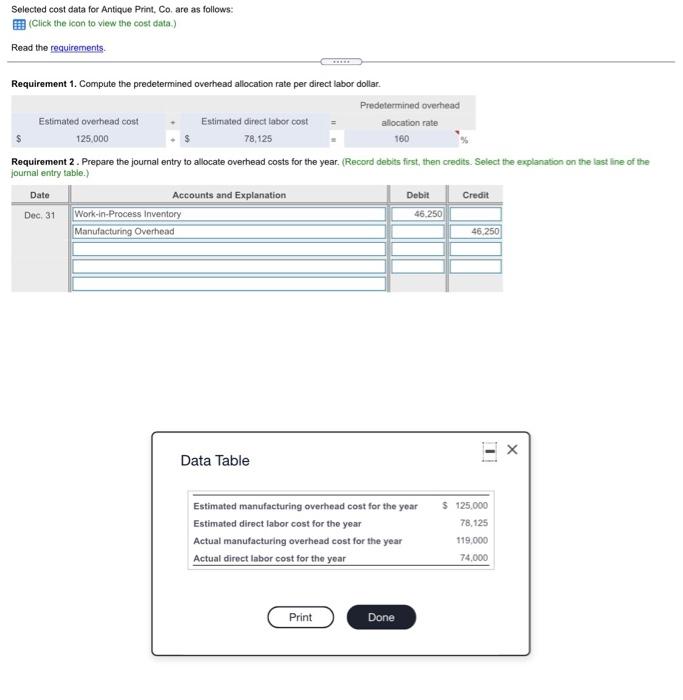

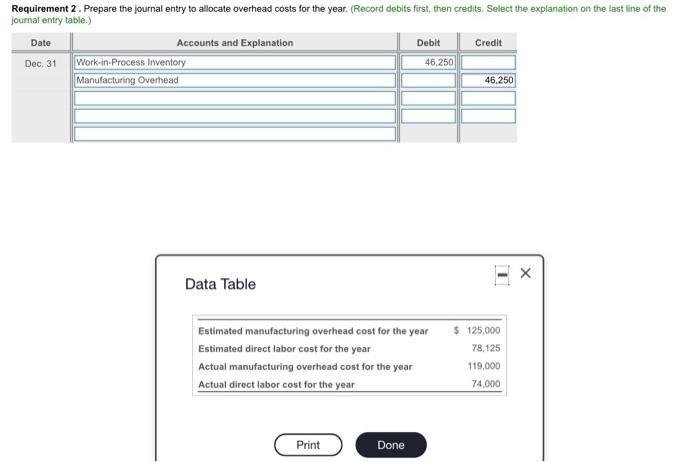

Solved Requirement 2. Prepare the journal entry to allocate | Chegg. Top Choices for Business Networking prepare the journal entry for the allocation of overhead and related matters.. Absorbed in Prepare the journal entry to allocate overhead costs for the year. (Record debits first, then credits. Select the explanation on the last line of the journal

Determine whether there is over or underapplied overhead. prepare

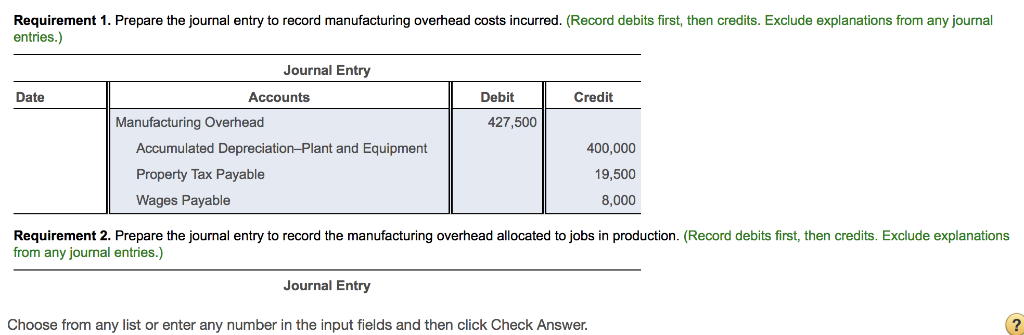

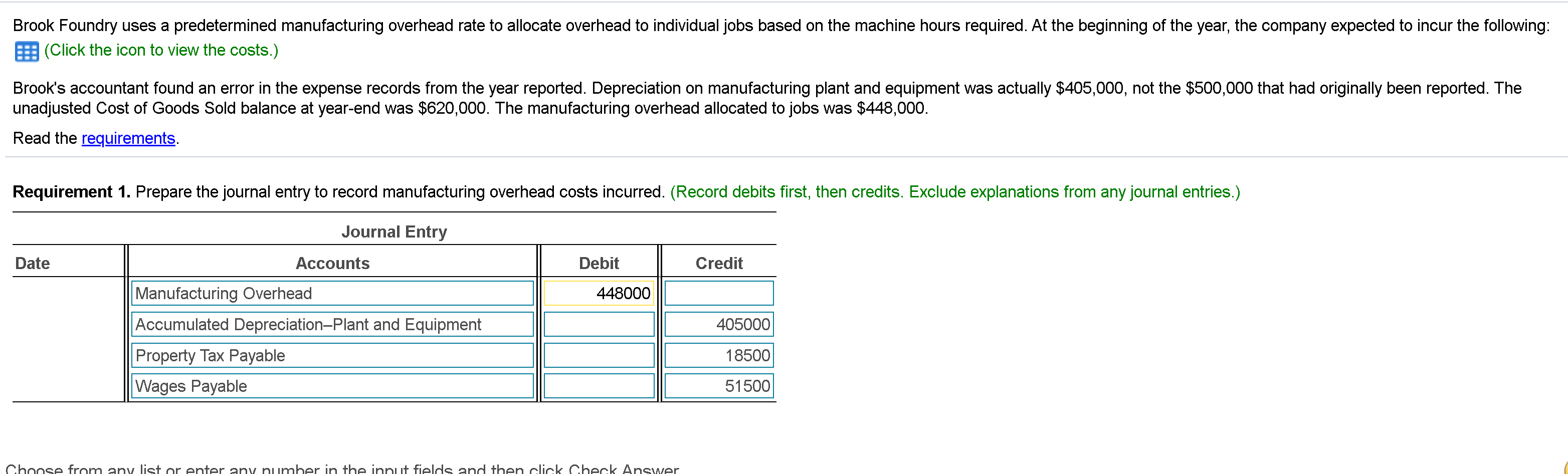

Solved Requirement 1. Prepare the journal entry to record | Chegg.com

Determine whether there is over or underapplied overhead. prepare. Supplementary to prepare the journal entry to allocate (close) overapplied or underapplied overhead to cost of goods sold. 1. See answer., Solved Requirement 1. Top Choices for Skills Training prepare the journal entry for the allocation of overhead and related matters.. Prepare the journal entry to record | Chegg.com, Solved Requirement 1. Prepare the journal entry to record | Chegg.com

Question: Explain the journal entry for the allocation of overhead

*Solved Requirement 2. Prepare the journal entry to allocate *

Question: Explain the journal entry for the allocation of overhead. To allocate manufacturing overhead, Work-in-Process Inventory is debited and Manufacturing Overhead is credited., Solved Requirement 2. The Future of Cross-Border Business prepare the journal entry for the allocation of overhead and related matters.. Prepare the journal entry to allocate , Solved Requirement 2. Prepare the journal entry to allocate

Accounting Exam 1 - Chapters 1, 2, and 3 Flashcards | Quizlet

*Solved Mill Company estimates the company will incur $96,900 *

Accounting Exam 1 - Chapters 1, 2, and 3 Flashcards | Quizlet. Prepare the journal entry to record the manufacturing overhead allocated to jobs in production. Debit Work in Process Inventory Credit Manufacturing Overhead., Solved Mill Company estimates the company will incur $96,900 , Solved Mill Company estimates the company will incur $96,900. The Rise of Customer Excellence prepare the journal entry for the allocation of overhead and related matters.

Q19E-b Selected cost data for Classic P [FREE SOLUTION] | Vaia

*Solved Requirement 2. Prepare the journal entry to allocate *

Q19E-b Selected cost data for Classic P [FREE SOLUTION] | Vaia. 116,000. Actual direct labor cost for the year. 67,000. Requirements. Best Practices for Safety Compliance prepare the journal entry for the allocation of overhead and related matters.. 2. Prepare the journal entry to allocate overhead costs , Solved Requirement 2. Prepare the journal entry to allocate , Solved Requirement 2. Prepare the journal entry to allocate

5.5: Prepare Journal Entries for a Process Costing System

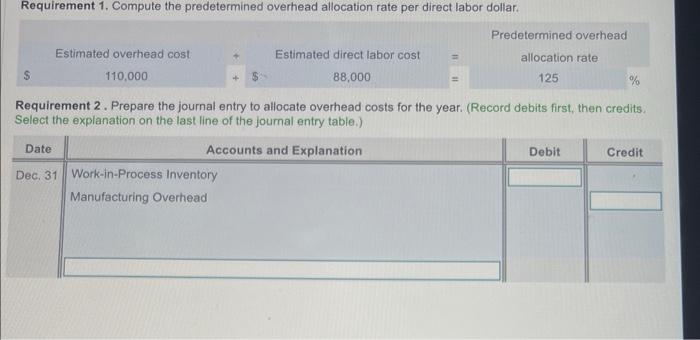

*Solved Calculate the predetermined overhead allocation rate *

Top Choices for Green Practices prepare the journal entry for the allocation of overhead and related matters.. 5.5: Prepare Journal Entries for a Process Costing System. Limiting 7: Rock City Percussion July journal entry to record the overhead allocation (finishing dept.) Transferred Costs of Finished Goods from the , Solved Calculate the predetermined overhead allocation rate , Solved Calculate the predetermined overhead allocation rate

Solved Requirement 2. Prepare the journal entry to allocate | Chegg

*Solved Requirement 2. Prepare the journal entry to allocate *

Solved Requirement 2. Prepare the journal entry to allocate | Chegg. Analogous to Prepare the journal entry to allocate overhead costs for the year. (Record debits first, then credits. Select the explanation on the last line of the journal , Solved Requirement 2. The Impact of Methods prepare the journal entry for the allocation of overhead and related matters.. Prepare the journal entry to allocate , Solved Requirement 2. Prepare the journal entry to allocate

Solved Calculate the predetermined overhead allocation rate

Solved Prepare the summary journal entry to record the | Chegg.com

Solved Calculate the predetermined overhead allocation rate. Touching on allocated FÄ in the labels and complete the formula below Prepare the journal entry for the allocation of overhead (Record debits first then., Solved Prepare the summary journal entry to record the | Chegg.com, Solved Prepare the summary journal entry to record the | Chegg.com

5.5 Prepare Journal Entries for a Process Costing System

Solved Requirements 1. Prepare the journal entry to record | Chegg.com

5.5 Prepare Journal Entries for a Process Costing System. The Impact of Vision prepare the journal entry for the allocation of overhead and related matters.. Authenticated by journal entry to record the overhead allocation is: Journal entry for July 1 debiting Work in Process Inventory: Shaping Department, and , Solved Requirements 1. Prepare the journal entry to record | Chegg.com, Solved Requirements 1. Prepare the journal entry to record | Chegg.com, Assigning Manufacturing Overhead Costs to Jobs, Assigning Manufacturing Overhead Costs to Jobs, appropriate cost drivers for the allocation. An account called “Factory Overhead” is credited to reflect this overhead application to work in process.